The outlook for gold in 2022

By V.P. Nandakumar

Gold ended the year 2021 with its price about 4% lower than its opening price for the year, closing at US$1,806/oz. This was despite a rally towards the year-end against the backdrop of the rapid spread of the Omicron variant which added to uncertainties. However, it was not enough to offset the weakness for much of the first half of the year. Rising opportunity costs (a booming equity market and higher bond yields) contributed to gold’s negative performance in the first half of the year, while rising risks, especially higher inflation, pushed gold higher towards the end of the year.

Source: WGC

As newly developed vaccines were rolled out early in 2021, there was a renewed sense of optimism among investors and stock markets rallied. This had a negative impact on gold price as it led to outflows from gold ETFs. The rest of the year was essentially a tug of war between competing forces. The emergence of new variants of the Corona virus together with the persistence of inflation gave renewed momentum to the demand for gold, pushing its prices up. On the other hand, the prospect of rising interest rates and a stronger US dollar continued to be headwinds for gold.Outlook for 2022

These days, the US Federal Reserve is increasingly signalling a more hawkish stance to bring the current high inflation under control. Market analysts have now veered around to the view that the Fed will hike interest rates four or five times this year beginning from March, which is a much faster pace than expected earlier. Further, there is also serious talk about reducing the size of the Fed’s balance sheet, in other words, a quantitative tightening that would cut down liquidity in the market. However, the record with previous tightening cycles suggests that the Fed tends to talk tough while acting with moderation. Therefore, there is a view that the Fed may not tighten monetary policy as aggressively as they are hinting at now.

Importantly, the expectations of the financial market about future monetary policy actions (as indicated by bond yields) have a major influence on gold price. As bond yields go up, which is quite likely in a scenario of tightening monetary policy, the opportunity cost of holding a non-interest-bearing asset like gold goes up, and its price tends to weaken. However, in the current scenario, where the anticipated tightening of monetary policy takes place against the backdrop of surging inflation, it remains to be seen whether gold will indeed shed value the way the theory predicts. The fact is, with US inflation currently running at 7%, even after the Fed hikes rates four or five times in a row, the real interest rate (i.e., adjusted for inflation) would continue to be deeply in negative territory.

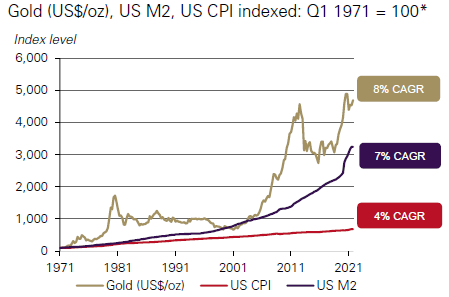

Further, as per the analysis carried out by the World Gold Council (WGC), gold has historically performed well amid high inflation. In years when inflation was higher than 3%, gold’s price increased 14% on average. In the long run, gold has outpaced US inflation and moved more in tune with money supply (M2), which has significantly increased in recent years as shown in the below chart

Source: WGC gold outlook 2022

Despite the prospect of impending rate hikes by the US Fed and some other central banks, nominal rates will remain low from a historical perspective. Further, as mentioned above, high inflation holds down real rates. This is important as gold’s short and medium-term performance is more closely tied to real rates, which combine the two important drivers of gold performance: “opportunity cost” and “risk and uncertainty”.

It is commonly believed that the price of gold is determined by investment demand, especially from financial instruments such as gold ETFs, over-the-counter contracts, or exchange-traded derivatives. This is only partly true. An analysis by the World Gold Council (WGC) shows that gold’s performance is also linked to other components of demand, such as jewellery, technology, and central banks. While these do not typically result in the large price movements associated with investment demand, they provide steady support and ensure a minimum level of demand to hold up prices at the bottom of the range.

Accordingly, gold can still receive moderate support in 2022 from key jewellery markets, such as India. Also, demand for gold from central banks which bounced back in 2021 may remain as a factor supporting gold price. Central banks have good reasons to favour gold as part of their foreign reserves given the current ultra-low interest rate environment. Even if US interest rates rise, high inflation will keep real interest rates down in the negative territory.

Gold price forecasts by leading market analysts

The predictions about gold prices for 2022 are quite varied as usual. The broader opinion among analysts is that gold will struggle to maintain its current levels. They believe that the economic recovery will continue to gain ground, limiting the potential upside gains for gold.

ANZ Bank and Singapore’s OCBC Bank are forecasting that the strength of the economic recovery will see gold fall to $1,500 - $1,600 per ounce as tapering begins and interest rates rise. UBS Global Wealth Management and Reuters predict that gold price in 2022 will average between $1,700 - $1,800 per ounce maintaining the levels of 2021.

In its commodities outlook report, Fitch Solutions also sees gold prices averaging lower in 2022, as the US dollar strengthens, and bond yields continue the climb higher. Their forecast is of gold prices averaging US$1,700 per ounce in 2022 with considerable volatility. Earlier, they had forecast a price of US$1,800 per ounce for 2021 which was quite on the mark. But now, their position is that while gold will get support in the near term from the current inflation running at a multi-decade high, this will be countered by the risk of the US Fed raising interest rates at a faster pace than expected by the market.

J.P. Morgan Global Research has a more pessimistic outlook as they expect gold prices to fall to pre-pandemic levels by the end of 2022. This is based on their view that the unwinding of the ultra-accommodative central bank policy will be outright bearish for gold in 2022. From an average of $1,765/oz in the first quarter, i.e., quarter ending March 2022, they predict that gold prices will steadily decline over the year to a fourth (December) quarter average of $1,520/oz.

ABN Amro’s outlook for gold in 2022 is even more bearish as they expect the yellow metal to average $1,500 and fall further to an average of $1,300 in 2023. Scotiabank’s gold forecast sees a move back above the $1,800 level to average $1,850 in 2022 but decline to $1,700 in 2023.

Here in India, Motilal Oswal Financial Services has a more optimistic take as it believes gold could touch $2,000 over the next 12–15 months. Their recommendation is that any price correction should be used as an opportunity to buy gold. In the short-term, they expect gold to reach about $1,915 this quarter going up thereafter to $1,965, with strong support seen in the $1,800 to $1,745 zone.

A final thought

As we enter 2022, there are two powerful forces acting in opposite directions that will determine the gold price trend for the year. On the one hand, it is all but certain that the US Fed will start increasing interest rates from March onwards. What remains to be seen is how aggressively they proceed with the rate hikes and the normalisation of monetary policy. There is a view gaining ground that the process should be kicked off with a 50 bps hike rather than the conventional 25 bps move. Should the Fed opt for faster and more aggressive tightening, gold price will come under pressure. On the other hand, the US economy has been facing high inflation at levels last seen four decades ago. The experience with inflation around the world is that once the genie gets out of the bottle, the process of putting it back in is invariably drawn out and painful.

With current US inflation running at 7%, it may be a little too optimistic to expect that the Fed Funds rate going up from zero to 1.5% or even 2% will do the trick, unless it tips the economy over into a recession by destroying demand. Indeed, at the first signs of trouble, such as rising unemployment and a sharp slowdown in GDP growth rates, we may reasonably expect the US Fed to ease off its tightening process. Should something like this happen, gold prices will bounce back. The key factor to watch out for is how far and how fast the US Fed goes with its rate hikes. While the intention at the start of the process would be to bring down inflation to the 2% level that’s been the Fed’s target for long, the question remains whether the Fed would stay committed to this goal if the costs turn out to be too heavy.

Finally, adding to all the uncertainty is the future of crypto currencies like Bitcoin and Ethereum. There’s no doubt that crypto currencies have attracted a fair share of investments from players who are fundamentally sceptical about fiat currency and all the money printing taking place globally. Had it not been for the rise of crypto currency, this money would have flown into gold which is otherwise the natural hedge against inflation. The question now is, how long will the crypto boom last? If the bubble were to burst any time soon, it will lead to more money coming into gold and that would become a powerful tailwind for gold price. So, how soon can we expect the crypto bubble to burst? For now, there’s little that can be said with certainty. It’s been well said before that the market can stay irrational longer than you and I can stay solvent.

Published in Unique Times Magazine, February 2022

(V.P. Nandakumar is MD & CEO of Manappuram Finance Ltd. Views are personal.)