Overview of the Company

Manappuram Finance Ltd. is one of India’s leading gold loan NBFCs. Promoted by Shri. V.P. Nandakumar, the current MD, its origins go back to 1949 when it was founded in the coastal village of Valapad (Thrissur District) by his late father Mr. V.C. Padmanabhan. The firm was involved in pawn broking and money lending carried out on a modest scale. Shri Nandakumar took over the reins in 1986 after his father expired.

Since then, it has been a story of unparalleled growth with many milestones crossed. Incorporated in 1992, Manappuram Finance Ltd. has grown at a rapid pace. Today, it has more than 5000 (Includes branches of subsidiary companies) branches across 28 states/UTs with assets under management (AUM) of Rs. 443 billion and a workforce of more than 50,000.

Management Team

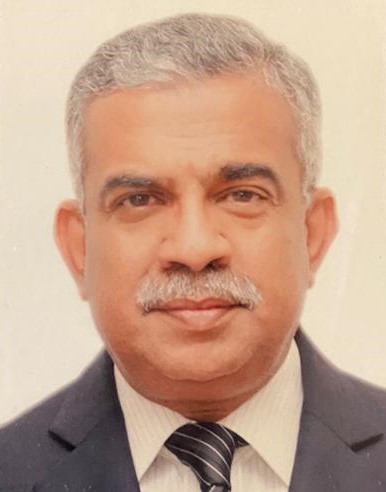

Mr. V.P. Nandakumar

Chairman and Managing Director

Mr. V.P. Nandakumar is a postgraduate in science with additional qualifications in Banking & Foreign Trade. Immediately after completion of his education, he joined the erstwhile Nedungadi Bank Limited. In 1986, he resigned from the Bank to take over the family business, upon the demise of his father, V.C. Padmanabhan. In 1992, he promoted Manappuram Finance Ltd. and has been a director of the company since then. In the past, Mr. Nandakumar has been associated with leading trade and industry associations such as ASSOCHAM and CII in various capacities. He is currently the Chairperson of the State Council of FICCI Kerala.

Directorship

- Manappuram Health Care Limited

- Manappuram Construction and Consultants Limited

- Manappuram Home Finance Limited

- Asirvad Micro Finance Limited

- Manappuram Chits (Karnataka) Private Limited

- Manappuram Chit Funds Company Private Limited

- Manappuram Insurance Brokers Limited

- Manappuram Comptech and Consultants Limited

- Adlux Medicity And Convention Centre Private Limited

- Manappuram Chits (India) Limited

- Manappuram Agro Farms Limited

- Manappuram Jewellers Limited

- Finance Industry Development Council

- SNST Advisories Private Limited

- DTA Advisory Private Limited

- DTB Advisory Private Limited

- DT3 Advisory Private Limited

Dr.Sumitha Nandan

Execuitve Director.

Dr. Sumitha Nandan, a medical professional who has M. S. in Obstetrics & Gynaecology from Sri Ramachandra Institute of Higher Education and Research, Chennai has entered the family business from the 03rd generation, after successfully practising in leading hospitals in Kerala & Chennai.

After joining the family business, she has taken up multiple IT initiatives to enhance customer experience. One of the initiatives is online gold loan, where she has championed the execution and last mile delivery and awareness of OGL. The other initiative is digitalizing auction procedures so that the transparency is enhanced and participation of the customers can be fulfilled.

She is an Alumnus of Wharton Business School following completion of Advanced Finance Programme. She had held the whole time Director positions in Manappuram Health Care Limited and Macare Dental Care Private Limited. She had also held Directorships in Manappuram Home Finance Limited, Manappuram Agro Farms Limited, Systemic Ayurvedic Research Private Limited and Asirvad Micro Finance Limited. After the onboarding of Bain Capital on board, she will continue in the executive role as an Executive Vice Chairman.

Board of Directors

Mr.Abhijit Sen

Independent and Non-Executive Director.

Mr. Sen retired as Chief Financial Officer- Citibank, India Subcontinent in 2015 after serving the organisation for almost 20 years. Post retirement he is associated with a large Big 4 firm as an External Advisor, for their activities in the Banking and Financial Services Sector. He serves on several Boards including Kalyani Forge Ltd, Trent Ltd , U Gro Capital ,Ujjivan Micro-Finance Ltd. and Cashpor Microcredit. He also chairs the Audit Committees of Kalyani Forge Ltd, Trent Ltd and U Gro Capital in addition to participating on several other Board Committees. In the past, Abhijit was also on the Board of National Securities Depository Ltd and various Citi entities and has been an External Advisor to General Atlantic. He has a B.Tech (Hons) degree from the Indian Institute of Technology, Kharagpur and a Postgraduate Diploma in Management from the Indian Institute of Management, Kolkata with Majors in Finance & Information Systems.

Read more

Mr. Harshan Kollara

Independent and Non-Executive Director.

Experienced Financial Services professional, with over 40 years of experience in banking & Financial services in India and abroad. Has been with diverse institutions (Union Bank of India, ICICI bank (as EVP and Head of International banking), Union bank of California (as Vice president and Regional Head of South Asia Region) and Federal bank (as its Executive Director). Good project management experience in setting up institutions. Has been Non-Executive Director, Experian credit information co of India p ltd. Mr Kollara is also has an “approved person” status with FCA the Financial Regulator of UK . Extensive hands on experience in foreign exchange, trade Finance, cross border payments, consumer credit, Core banking application system implementation, and compliance including AML, CTF & financial crime prevention practices. Experience in global standards and best practices in Governance. Harshan is an alumnus of Mumbai University.

Directorship and full-time positions in other Body Corporates

- Asirvad Micro Finance Limited

- Fenca Ltd UK (Formerly Fast Encash money transfer services-Ltd )

- Value Finance Corporation Limited ( Full time)

- Value Finance Ltd

- Morgan & Harvey Services Ltd

- Abans Global Ltd,UK

- Rebar Design and Details Ltd

- Association of UK Payment and Fintech Companies

- Gateway Gardens (Block B) Management Ltd

- Saral Money Ltd

Read more

Ms.Pratima Ram

Independent and Non-Executive Director.

Ms. Pratima Ram is an experienced banker with over three decades in Corporate, International, Investment & Retail Banking. She has worked in India, USA and South Africa. Pratima held the position of Country Head & Chief General Manager of the United States Operations of State Bank of India, in New York, and prior to this she was the CEO of the South African operations of the Bank based at Johannesburg. At SBI Capital Markets, she assisted companies in raising funds through capital market instruments and led the Corporate Advisory, M&A, & Project Appraisal business. She also led the training initiatives of SBI as head of the SBI Academy. On leaving the public sector, she joined private sector in the infrastructure and Oil & Gas space as Group President Finance at Punj Lloyd Group having diversified operations then in more than 15 countries.

Pratima was CEO and Whole Time Director of India Infoline Finance Ltd, IIFL, a large Non-Banking Finance company focused on lending to small businesses, Real Estate and Health Care sectors. She also held the CEO position at India Infoline Housing Finance Ltd. She has experience as independent Director on Boards of corporates in the electrical, auto, textiles, energy, and mining industry. She also mentors startups in IT, renewable energy and agriculture sectors. She earlier held Board position in SBI California Ltd, USA, India Infoline Finance Ltd, Mumbai, Havells India.

In Bangalore, she is on the Finance Committee of Bangalore International Centre, an initiative of TERI, set up on the lines of India International Centre. She was member of the Executive Committee of Bangalore International Centre and was on the Management Committee of Bangalore Chambers of Industry and Commerce and on their sub-Committees on Banking & Finance. She has been associated with CII for their programmes for Small & Medium industry. When in USA, she was associated with the activities of US-India Business Council & Asia Society and was an elected member of the executive committee of the Institute of International Bankers, USA

She takes keen interest in mentoring and advising medium size corporate, using her expertise gained in Corporate Banking & Advisory, Forex management and Risk management as well as experience gained in public & private sector industry. She is also deeply involved in improvement of rural school education in North Karnataka.

Pratima graduated from University of Virginia, USA and Bangalore University.

Directorship

- Minda Corporation Limited

- GPS Renewables Private Limited

- Avaali Solutions Private Limited

- Minda Instruments Limited

- Manappuram Home Finance Limited

Read more

Adv. Veliath Pappu Seemanthini

Independent and Non-Executive Director.

Adv. Veliath Pappu Seemanthini is a law graduate and a Senior Advocate designated by High Court of Kerala. She is also a Standing Counsel for various Central Government and State Government Institutions like High Court of Kerala, Food Corporation of India, National Insurance Company, Coir Board, Steel Authority of India (SAIL), Bokaro Steel Plant, Vishakhapatnam Steel Plant, Steel Industries Kerala Ltd, Kerala Feeds Limited, Kerala State Women’s Commission, Institute of Management Studies, Trivandrum, South Malabar Gramin Bank. She is Practicing in the Supreme Court of India, High Court of Kerala and various other Courts and Tribunals. Mainly handling cases in Constitution. She is also involved and committed to various social activities such as :-

- Regional Director (India) of International Federation of Women Lawyers (Asia Region).

- The President of All India Federation of Women Lawyers during (2009 – 2010).

- President of Indian Federation of Women Lawyers (Kerala Branch) on two spells.

- Attended various seminars and conferences in relation to women and children and has been espousing the cause of women. Had been mediator and amicus curie as requested by the High Court in various cases.

- Dedicated to the promotion of welfare of women and children and other socially, educationally and economically backward sections of the society.

- Secretary of Kerala High Court Senior Advocate Association.

- Member of Indian Law Reports Council (Kerala Series).

- Member of High Court Legal Service Committee.

- President, Central Administrative Tribunal Advocate Association.

Directorship and full-time positions in other Body Corporates

- Guru Deva International Mission

Read more

Dr. Sankaran Nair Rajagopal

Independent and Non-Executive Director.

Dr. S. Rajagopal is a seasoned banking professional with over three decades of experience in Reserve Bank of India and three years with leading commercial banks. As the Regional Director of RBI, Dr. Rajagopal spearheaded its operations in Maharashtra & Goa, serving as the Ex-Officio Alternate Co-chairman of State level Bankers’ Committees of these states. He was the Chairman of Empowered Committees for MSMEs in both the states as also the Chairman of the Empowered Committee for Regional Rural Banks in Maharashtra.

His tenure at the Financial Stability Unit saw him as a member of the Analytical Group on Vulnerabilities (AGV) of Financial Stability Board, Basle, Switzerland. Dr. Rajagopal’s expertise spans across areas such as supervision and regulation of Commercial banks and Urban Co-operative banks, financial stability analysis, payment system operations, foreign exchange, financial inclusion, currency management, human resources management and training. He also served as a Nominee Director on the Board of the Bank of Maharashtra and also as nominee Director of RBI in Global Trust bank (till amalgamation with OBC).

Currently, Dr. Rajagopal lends his expertise as a Part-time Consultant to a leading Law Firm. His academic credentials include an MBA in International Management from the University of Dallas, USA, an MBA in Banking and Finance from the University of Science & Technology (CUSAT), and Ph.D. in Management from the University of Pune. He also holds a Diploma in Training & Development from the Indian Society for Training & Development and is a Certified Associate of the Indian Institute of Bankers (CAIIB).

Dr. Rajagopal has also served as a Visiting Professor in S.P.Jain School of Global Management in their Singapore & Dubai campuses. His insights and thought leadership have been published in leading financial dailies and journals. In his spare time, Dr. Rajagopal enjoys traveling and exploring new cultures, which helps him bring a global perspective to his work.

Directorship

- Incred Financial Services limited

Read more

Mr. Edodiyil Kunhiraman Bharat Bhushan

Independent and Non-Executive Director.

Mr. Edodiyil Kunhiraman Bharat Bhushan had thirty-six years of experience as an officer of Indian Administrative Service with impactful roles in Central and State governments. He has experience in designing and implementing policy in multiple sectors such as trade, industries, agriculture, aviation. He was the CEO of India’s largest Rubber Plantation company. He set up the first federation of growers of rubber, a unique experiment in marketing, aimed at ensuring fair price to small growers. He was the CEO of Milk Federation and tasked with managing Operation Flood, aimed at achieving self-sufficiency in milk production in Kerala. He also coordinated Swiss developmental assistance for the dairy sector. He was the Chief Secretary of Kerala State managing all departments of Government, overseeing 6,00,000 employees. He was responsible for implementation of all Government programmes in the State. He played an important role in turning around of Kerala Minerals and Metals – the largest PSU in the state of Kerala from a BIFR company to a profit earning one. As the Secretary, Tourism, Kerala, he led the God’s own country campaign, one of the most successful super brands in the country. He contributed as Special Secretary, Steel Ministry, Government of India, in achieving record steel production and revenue in SAIL, through a disciplined CAPEX program. He directed the design and development of India’s first Semiconductor Policy and its accompanying incentive programmes. He assisted in the commissioning of India’s first IT Park in Trivandrum as Secretary, Industries. Technopark has now grown to become one of the largest IT parks in the country employing over 1,00,000 people. He is credited with introducing the Price Stabilising Fund for Plantations and operationalising an effective Market Intervention Operation (MIO). He held charge of Aviation Safety Regulator viz. Director General Civil Aviation and was responsible for developing a detailed domestic safety protocol for Aviation, adopted in line with international norms and aimed at optimal maintenance of aircraft and airports.

Directorship

- Cochin International Airport Limited

Read more

Code of Conduct For Board And Senior Management

Manappuram Finance Ltd is committed to upholding the highest standards of moral and ethical values in the conduct of its business. The board of directors, senior management and all employees of this company share this commitment. The company has adopted the following code of conduct as its policy guide in the conduct of its business. Commitment to ethical professional conduct is expected of every member and all employees should understand and implement the code adopted by the company in its true spirit.

For the purposes of this code the Board means all directors of the company including the chairman and managing director. Senior management shall mean Deputy General Managers, all functional heads reporting to the Chief Executive Officer and the Company Secretary.

Honesty, integrity and diligence are the fundamental aspects qualifying every act on the part of the board and senior management. They should act in good faith for and on behalf of the company and adopt the highest standards of personal ethics, integrity, confidentiality and discipline in dealing with all matters relating to the Company

Any confidential information obtained during the course of their duty should not be used for personal aggrandizement or financial gain to self or to a third party.

They shall not engage in any business, which is detrimental to the interests of the company. They shall maintain the confidentiality of all material and non-public information about the company or its business and must always act in the best interests of the Company and its stakeholders.

They Shall not accept any gifts, benefits in cash or in kind or other personal favours from the customers or from those seeking any business from the company and shall conduct the activities outside the Company in such manner as not to adversely affect the image or reputation of the Company.

The directors shall not associate with other Non Banking Financial Companies registered with RBI outside the group either as a Director or in any managerial or advisory capacity, (not including statutory compliance and audit) without the prior approval of the Board.

They must obey existing local, state, national, and international laws unless there is a compelling ethical basis not to do so.

They shall strive to achieve the highest quality, effectiveness and dignity in their work and must accept social responsibilities for their acts.

They shall always abide by the Code of Conduct, and shall be accountable to the Board for their actions/violations/defaults

Independent directors shall have following duties:

The independent directors shall -

Undertake appropriate induction and regularly update and refresh their skills, knowledge and familiarity with the company;

Seek appropriate clarification or amplification of information and, where necessary, take and follow appropriate professional advice and opinion of outside experts at the expense of the company;

Strive to attend all meetings of the Board of Directors and of the Board committees of which he is a member;

Participate constructively and actively in the committees of the Board in which they are chairpersons or members;

Strive to attend the general meetings of the company;

Where they have concerns about the running of the company or a proposed action, ensure that these are addressed by the Board and, to the extent that they are not resolved, insist that their concerns are recorded in the minutes of the Board meeting;

Keep themselves well informed about the company and the external environment in which it operates;

Not to unfairly obstruct the functioning of an otherwise proper Board or committee of the Board;

Pay sufficient attention and ensure that adequate deliberations are held before approving related party transactions and assure themselves that the same are in the interest of the company;

Ascertain and ensure that the company has an adequate and functional vigil mechanism and to ensure that the interests of a person who uses such mechanism are not prejudicially affected on account of such use;

Report concerns about unethical behaviour, actual or suspected fraud or violation of the company’s code of conduct or ethics policy;

Acting within his authority, assist in protecting the legitimate interests of the company, shareholders and its employees;

Not disclose confidential information, including commercial secrets, technologies, advertising and sales promotion plans, unpublished price sensitive information, unless such disclosure is expressly approved by the Board or required by law.

In addition to the above duties an independent director shall be subject to following professional conduct:

An independent director shall:

Uphold ethical standards of integrity and probity;

Act objectively and constructively while exercising his duties;

Exercise his responsibilities in a bona fide manner in the interest of the company;

Devote sufficient time and attention to his professional obligations for informed and balanced decision making;

Not allow any extraneous considerations that will vitiate his exercise of objective independent judgment in the paramount interest of the company as a whole, while concurring in or dissenting from the collective judgment of the Board in its decision making;

Refrain from any action that would lead to loss of his independence;

Where circumstances arise which make an independent director lose his independence, the independent director must immediately inform the Board accordingly;

Assist the company in implementing the best corporate governance practices.

An independent director shall be held liable, only in respect of such acts of omission or commission by a company which had occurred with his knowledge, attributable through Board processes, and with his consent or connivance or where he had not acted diligently with respect of the provisions contained in the Listing Agreement.

Change in Directorship

Mr. Shailesh Mehta Stepped Down as director of the board of the company with effect from 22.08.2018.

Mr. V.M Manoharan, stepped down as a director of the board of the company w.e.f 25.07.2014.

There has been change in the designation of Mr. I Unnikrishnan from ED and deputy CEO to Non- Executive Director w.e.f. 30.11.2014.

Mr. I.Unnikrishnan stepped down as a director of the board of the company w.e.f 05.11.2015.

Mr. Amla Samanta has been appointed as an Independent Director of the Board with effect from 06.08.2015.

Mr. Pradeep Saxena Stepped Down as director of the board of the company with effect from 09.08.2016.

Mr. Gautam Ravi Narayan has been appointed as an "Non Executive Director" of the Board with effect from 21.08.2018.

Ms.Sutapa Banerjee has been appointed as Additional Director of the Board with effect from 06.02.2019.

Dr. Amla Samanta Stepped Down as director of the board of the company with effect from 01.04.2019.

Ms. Sutapa Banerjee has been appointed as Independent Director of the Board with effect from 01.04.2019.

Mr. Abhijit Sen has been appointed as an Additional Director of the Board with effect from 17.07.2019.

Mr. Abhijit Sen has been appointed as Independent Director of the Board with effect from 27.08.2019.

Mr. E A Kshirsagar Stepped Down as director of the board of the company with effect from 06.11.2019.

Mr. Rajiven V R had expired on 19.10.2019.

Mr. Harshan Kollara has been appointed as an Additional Director of the Board with effect from 28.01.2020.

Mr. Shailesh Mehta has been appointed as an Additional Director of the Board with effect from 27.02.2020.

Mr.B.N. Raveendra Babu Re-designated as Non Executive Director of the board of the company with effect from 31.05.2020.

Mr. Harshan Kollara has been appointed as Independent and Non-Executive Director of the Board with effect from 28.08.2020.

Mr. Shailesh. J. Mehta has been appointed as Independent and Non-Executive Director of the Board with effect from 28.08.2020.

Mr.Jagdish Capoor Stepped down as director of the board of the company with effect from 18-10-2021.

Mr.Shailesh J. Mehta has been appointed as Chairman of the board with effect from 13-11-2021.

Mr.B N Raveendra Babu, stepped down as Non-executive Non-Independent Director of the Board with effect from 18.05.2022.

Ms.Sutapa banerjee, stepped down as Non-executive Independent Director of the Board with effect from 04.07.2022.

Ms.Pratima Ram (DIN-03518633) has been appointed as Non-executive director of the Board w.e.f 23.09.2022.

Adv. Veliath Pappu Seemanthini (DIN: 07850522) has been appointed as Non-Executive Director (Independent) of the Board w.e.f 23.12.2022.

Dr.Sumitha Nandan (DIN:03625120 ) has been appointed as Additional Director (Executive ) of the Board w.e.f 01.01.2023.

Vide Postal ballot results dated 03rd Feb 2023,Shareholders approved the appointment of Adv. Veliath Pappu Seemanthini (DIN: 07850522) as Independent Non-Executive Director of the Board w.e.f 23.12.2022.

Vide Postal ballot results dated 03rd Feb 2023,Shareholders approved the appointment of Dr.Sumitha Nandan (DIN:03625120 ) as Executive Director of the Board w.e.f 01.01.2023.

Mr.Gautam Ravi Narayan, Stepped down as director of the board of the company with effect from 04.04.2023.

Mr. T C. Suseel Kumar (DIN: 06453310) has been appointed as Additional Director (Non-Executive Independent) of the Board with effect from 01.11.2023.

Dr. Sankaran Nair Rajagopal(DIN:10087762) has been appointed as Additional Director (Non-Executive Independent) of the Board with effect from 01.01.2024.

Vide Postal Ballot result dated December 28,2023, Shareholders approved the appointment of Mr. T C Suseel Kumar (DIN: 06453310) as Independent Non-Executive Director of the Board w.e.f Novenber 1,2023.

Vide Postal Ballot result dated December 28,2023, Shareholders approved the appointment of Ms. Pratima Ram (DIN: 03518633) as Independent Non-Executive Director of the Board w.e.f April 1,2024.

Vide Postal Ballot result dated December 28,2023, Shareholders approved the appointment of Dr. Sankaran Nair Rajagopal(DIN:10087762) as Independent Non-Executive Director of the Board w.e.f Janauary 1,2024.

Mr. Edodiyil Kunhiraman Bharat Bhushan (DIN: 01124966), has been appointed as Additional Director (Non-Executive Independent) of the Board with effect from 01.03.2024.

Vide Postal Ballot result dated April 03,2024, Shareholders approved the appointment of Mr. E.K. Bharat Bhushan (DIN: 01124966) as Independent Non-Executive Director of the Board w.e.f March 1,2024.

Mr. S.R Balasubramanian(DIN: 03200547), stepped down as Non-Executive Director of the Board with effect from 09.05.2024.

Mr. P. Manomohanan(DIN: 00042836 ) and Mr. V.R. Ramachandran(DIN: 00046848) ceased to be the directors of the company w.e.f 31.07.2024.

A Profile of the MD

Mr. V.P. Nandakumar

Chairman and Managing Director

Mr. V.P. Nandakumar is a post graduate in science with additional qualifications in Banking & Foreign Trade. Immediately after completion of his education, he joined the erstwhile Nedungadi Bank Limited. In 1986, he resigned from the Bank to take over the family business, upon the demise of his father, V.C. Padmanabhan. In 1992, he promoted Manappuram Finance Ltd. and has been a director of the company since then. In the past, Mr. Nandakumar has been associated with leading trade and industry associations such as ASSOCHAM and CII in various capacities. He is currently the Co-Chair of the State Council of FICCI Kerala.

Mr. V.P. Nandakumar is the Managing Director & CEO of Manappuram Finance Ltd, one of the country’s leading non-banking finance companies. Manappuram’s origins go back to 1949 when it was founded by the late V.C. Padmanabhan, father of Mr Nandakumar. In those days, its activity was money lending carried out on a modest scale at Valapad in Thrissur district of Kerala. Mr Nandakumar took over the reins of this one-branch business in 1986 after his father expired. Since then, it has been a story of unprecedented growth, and his leadership was instrumental in scripting the success story.

Mr Nandakumar has led from the front to transform Manappuram Finance Ltd into a leading NBFC with 5,200 branches in 28 states and UTs and Assets Under Management (AUM) of ₹40,385 crore, and around 47,000 employees. In recent years, Mr Nandakumar has resolutely steered the company’s diversification into microfinance, home loans, vehicle finance, SME and personal loans to reshape the company into a full-spectrum NBFC. Today, as much as 49% of the company’s total business comes from the non-gold businesses.

Mr Nandakumar’s achievements in business have earned recognition at the national level. In May 2018, the Business World magazine profiled him as one among 40 of India’s most valuable CEOs. In December 2019, the Economic Times published the ET500 list of Top Wealth Creators of 2019 with Manappuram as the ‘chart topper’. In February 2023, Mr Nandakumar bagged The Hurun Industry Achievement Award 2022 from Hurun India for his remarkable achievements in the world of business. In February 2024, he was adjudged 'Financial Success Champion' at the Elets BFSI CXO Awards for entrepreneurial excellence in the field of financial service business.

Besides focus on business, the cause of the wider community is central to his vision. He established the Manappuram Foundation at Valapad in 2009 to drive the corporate social responsibility (CSR) mission of the Manappuram group.

Manappuram Foundation expanded its area of services to the grassroots of the community through its various initiatives. The Foundation now manages two schools, various coaching centres for varied skills, yoga centres, counselling & psychotherapy centres, fitness and wellness centres and a sports complex with badminton/basketball courts and an aquatic complex with state-of-the-art swimming pool. It also has a fleet of ambulances equipped with advanced medical support systems and services of experienced paramedics. All the services in these institutions are offered to the BPL community at subsidised rates.

Besides Manappuram Finance Ltd., V.P. Nandakumar was elected to serve as international director of Lions Clubs International at the association’s 102nd International Convention, held in Milan, Italy, in July, 2019. He became a Lion in 1981 after joining the Triprayar Lions Club. Nandakumar has held a number of offices within the association including multiple district council chairperson, board appointee, and member of the LCIF Corporate, Foundation & Government Gifts Committee. Past Director Nandakumar held additional leadership responsibilities as the current Chair of LCCIA and the Chairperson of ISAME area Leadership.

Mr Nandakumar was involved as a promoter of Equitas Small Finance Bank Ltd (India’s first SFB) and Aptus Value Housing Finance India Ltd, which were subsequently listed on the stock exchange. He was also a promoter of Five Star Business Finance Ltd, an NBFC dealing in MSME finance.

Mr V.P. Nandakumar was born in 1954 and holds a post-graduate degree in science with additional qualifications in Banking and Foreign Trade. He has been a managing committee member of leading trade and industry associations such as FICCI, Assocham and FIDC. In January 2019, he was appointed to the Board of Governors of the Indian Institute of Management, Kozhikode. He is also a Distinguished Invitee to the All India Management Association’s Council of Management and the Co-Chair of the State Council of FICCI Kerala.

Promoter Group Entities

Manappuram Finance Limited is promoted by Mr.V.P.Nandakumar and is registered with Reserve Bank of India as a Non Banking Finance Company. The other companies / entities owned or controlled by Mr.V.P.Nandakumar are given below:-

Manappuram Asset Finance Limited

Maben Nidhi Limited (Formerly Manappuram Benefit Fund Limited)

Manappuram Health Care Limited

Manappuram Jewellers Limited

Manappuram Chits India Limited

Manappuram Chits (Karnataka) Private Limited

Manappuram Chit Funds Company Private Limited

Manappuram Construction and Consultants Limited

Manappuram Agro Farms Limited

SNST Advisories Private Limited

Other Entities

Manappuram Chits India

Manappuram Travels

Manappuram Finance Limited does not have any equity or other interest in any of the companies / entities owned or controlled by promoters mentioned above.

Brand Manappuram, the early days

How a local brand became a National Brand

To talk about how Manappuram evolved from a local brand to a national brand is to begin with an exaggeration.

For much of its life, Manappuram was not even a local or regional brand in the sense we would understand the term to mean today. In fact, Manappuram began as a village brand, and that was how it stood for many decades. It was strongly identified with the village of Valapad where it was established in 1949, and where it functioned as a single branch business involved in money lending and pawn broking on a modest scale. This was how remained until 1986, when its founder Shri V.C. Padmanabhan (father of Shri V.P. Nandakumar) expired.

Remarkably, even as it remained a business with strictly limited reach, it had managed to become a highly successful and greatly trusted brand with deep roots in the local community. Over the decades, Shri Padmanabhan had earned a reputation for integrity and the firm became known in the area as a safe-haven for the deposits of the local people, offering them higher returns along with assured safety. True to the stereotype of a conservative banker, Shri Padmanabhan was averse to risks. He ran his business on a capital base of Rs.5 lakhs and had imposed upon himself a voluntary limit of Rs.25 lakhs being the maximum deposits he would accept from the public. Beyond this limit, potential depositors were either turned away or made to wait for their turn in a queue. As and when an existing depositor withdrew his money, Shri Padmanabhan would send out inland letters to the next in line, informing them of the availability of a slot and grateful depositors would rush in with their money.

And such was the formidable reputation of the firm that even as it remained anchored in Valapad, the deposits came in from around the world, from locals who had moved out of the Valapad area to the Gulf countries and to other parts of India in search of employment, and who continued to carry their trust in the Manappuram name with them.

When Shri Nandakumar took over the reins in 1986, it was this resolute trust in the Manappuram name—the goodwill that served as a hidden capital of the business—that he was able to leverage. Very early on, he decided to do away with the voluntary limits on deposits and loans and business levels shot up, quickly going over the one crore rupee mark and beyond. However, before long, the limitations of operating under a proprietary concern became clear and Manappuram Finance Limited (MAFIL) was incorporated in 1992. The company went in early for an IPO in 1995 because the experience of trying to raise funds from the Commercial Banks was frustrating—even after mortgaging his personal residence, Banks were unwilling to lend him the amounts he was looking for. But the financial implications of a public issue were daunting. At that time, the rule was that a company going in for the IPO should have a minimum of Rs.3 crores as paid-up capital and MAFIL, at the time, was about half of that. Shri Nandakumar launched an initiative to collect small retail investments from among the Manappuram customers belonging to the Valapad area who were personally known to him. Once again, it was the trust that people of the area had in the Manappuram name that came to his rescue. The funds were mobilized and the issue went through without a hitch.

This was how Manappuram Finance Limited (MAFIL) got its start and the rest, as they say, is history.

The Social Relevance of Gold Loans

V.P. Nandakumar, MD & CEO.

In recent months, there’s been a spate of media articles focussed on the success enjoyed by the leading players in the gold loan segment (incidentally, one of India’s fastest growing businesses), and how more and more people are shedding age-old taboos to borrow money against their gold jewellery. While this traditional business of lending money against gold was professionalized and scaled-up in recent years by Kerala-based NBFCs, all the major national banks have now jumped into the fray with enthusiasm. Moreover, the media attention is not restricted to India alone. Both the New York Times (“Out from India’s alleys, gold loans gain respect,” September 28, 2009) and the Washington Post (“In India, gold loans gain popularity as precious metal's prices soar,” January 12, 2010) recently carried stories about the growing popularity of gold loans in India.

It is therefore an apt moment to acquaint the reader with an insider’s perspective on why gold loans matter and why they hold so much promise for our country’s future.

Gold and domestic savings

In India the savings habits of the poor and lower classes differ significantly from the richer sections. While the rich invest their savings across many different kinds of assets, the poor continue to invest their savings mainly in gold. In fact, in rural areas, this is often a necessity because of lack of access to banks. Also, there are strong cultural factors at work in India which make gold not only a desirable but also a necessary asset to hold. Gold is traditionally a store of value, protecting our savings from inflationary devaluation. It also serves important ceremonial purposes, such as in a wedding celebration where gold is always the preferred gift. With increasing prosperity and sophistication, the relative importance of gold to the well-off may have declined, but among the poor it continues to rule.

The debt-trap

People in a rural, agrarian society will necessarily face the problem of fluctuating or unsteady incomes. The bulk of their earnings come in the two harvest seasons and the rest of the year can be difficult. It is no surprise that they frequently resort to borrowing money. Quite often, this involves a trip to the local money lender. The money lender is willing to oblige but the interest rates are sky-high which makes repayment a big concern. Loans go into a cycle of defaults and rollovers at ever higher rates of interest and, occasionally, the money lender ends up with the title to the property of the borrowers.

The many advantages of gold loans

If only people would fall back on their savings in the form of gold, and borrow money at reasonable rates of interest against the pledge of their gold ornaments, the debt-trap can be curbed to a large extent. Yet it does not happen because we are all emotionally attached to our gold jewellery and, even in these more permissive times, there is a stigma attached to pledging gold to borrow money. In fact, it is considered a sign of desperation so that when people borrow against gold, they don’t want their neighbours to know of it. And so, the reality is that rather than use their gold to raise money, their instinctive preference is to go to a moneylender and borrow at exorbitant rates.

Avoids debt trap: A gold loan is settled either by repayment or, in case of default, by sale of the pledged security. The cycle of non-payment and rollovers of the loan at escalating rates of interest does not happen. In the worst case the borrower may lose his gold but there is no debt trap.

Simple procedures, fast disbursal: The formalities in availing gold loans are minimal and procedures are simple. In practice, the entire process should hardly take fifteen to twenty minutes. This makes gold loans ideal for the micro-finance segment where the loan amounts are small and where there is no point in testing the borrower’s patience with elaborate procedure.

No depreciation of underlying asset: Unlike other secured loans, the underlying asset in a gold loan is not subject to depreciation. At the same time, unlike land, it is a liquid asset and the transaction costs involved when enforcing the security are minimal. Thanks to this, the lender always enjoys a degree of comfort not available in other loans, and he does not have to go chasing after the borrower for timely repayments of instalments or EMIs. As for a borrower facing temporary difficulties, the only compulsion is to keep on servicing the interest component, till his situation permits repayment.

In practice, without recourse: Gold loans are effectively given out on a “without recourse” basis. Although the fine print of the loan agreement incorporates the right of recourse to the other assets of the borrower, in practice, this is almost never enforced. Defaults are settled by sale of the pledged gold and losses (if any) are written off. There are no recovery agents to go chasing after the borrower and his other properties with threats of legal action, court orders etc. In contrast, in a typical “secured” loan from a bank, in addition to the primary security, you need to put up collateral and bring along a Guarantor who also gets hauled into court in case of default.

No questions asked: People often borrow money on account of social compulsions which cannot be avoided in our cultural context; occasions like weddings, festivals, religious and social obligations etc. In this context, there is no denying that India’s banking sector continues to carry a hangover from the days of credit rationing that bank lending must always be for “productive” purposes. On the other hand, gold loans recognise that someone urgently in need of money cannot instead be made to settle for a lecture on wasteful consumption. Money is advanced solely on the criterion of the value of gold pledged and questions about the purpose of the loan would only be to confirm that anti-social or wildly speculative activities are not involved.

Suited for the unorganised sector: Gold loans are ideal for those employed in the informal or unorganised sector and lacking documents to prove their incomes. This is a segment conventional banks generally avoid because their appraisal and credit scoring is based on formal documentation. Incidentally, more than 90 percent of India’s workforce is employed in the unorganised sector.

Moral pressure against default: The recent success of the micro-finance sector has brought attention to the advantage of the group approach when lending to the poor. The loan is extended to individuals in a group and a default by any one member leads to the entire group being denied subsequent loans. Therefore, there is collective moral pressure on each member from the rest of the group to repay in time.

Something like this is at work in a gold loan too. There is no group approach but the market practice that gold loans are generally extended against household used jewellery has a similar impact. The fact is, borrowers and their families are emotionally attached to their family jewellery. Very often, it would have been acquired during important occasions like a marriage or the birth of a child etc. Occasions of wilful default, particularly with intention to capitalise on fluctuations in gold prices, are few and far between.

It therefore stands to reason that banks and financial institutions that choose to scale-up their gold loan portfolios would be able to do so with minimum risks. And, from a regulator’s perspective, gold loans can actually serve to minimise systemic risks.

Gains for the wider economy: India has the world’s largest stock of privately held gold with informed estimates ranging from 15,000 to 20,000 tonnes of gold. When this gold is kept idle in our lockers and vaults, it is a drag on the Indian economy: it has the effect of keeping billions of dollars in savings (at a conservative price of $1,000 /oz., it amounts to about $480 to $ 650 billion) out of the financial system. This is a huge sum that otherwise could have been lent out to industries and for building infrastructure. When people borrow against gold (technically called “monetization”), the impact is to set in motion a whole new chain of economic activity boosting demand and consumption expenditure in the economy.

This is the classic debt-trap and a root cause of so much distress among the rural poor.

The many advantages of gold loans

If only people would fall back on their savings in the form of gold, and borrow money at reasonable rates of interest against the pledge of their gold ornaments, the debt-trap can be curbed to a large extent. Yet it does not happen because we are all emotionally attached to our gold jewellery and, even in these more permissive times, there is a stigma attached to pledging gold to borrow money. In fact, it is considered a sign of desperation so that when people borrow against gold, they don’t want their neighbours to know of it. And so, the reality is that rather than use their gold to raise money, their instinctive preference is to go to a moneylender and borrow at exorbitant rates.

- Avoids debt trap: A gold loan is settled either by repayment or, in case of default, by sale of the pledged security. The cycle of non-payment and rollovers of the loan at escalating rates of interest does not happen. In the worst case the borrower may lose his gold but there is no debt trap.

- Simple procedures, fast disbursal: The formalities in availing gold loans are minimal and procedures are simple. In practice, the entire process should hardly take fifteen to twenty minutes. This makes gold loans ideal for the micro-finance segment where the loan amounts are small and where there is no point in testing the borrower’s patience with elaborate procedure.

- No depreciation of underlying asset: Unlike other secured loans, the underlying asset in a gold loan is not subject to depreciation. At the same time, unlike land, it is a liquid asset and the transaction costs involved when enforcing the security are minimal. Thanks to this, the lender always enjoys a degree of comfort not available in other loans, and he does not have to go chasing after the borrower for timely repayments of instalments or EMIs. As for a borrower facing temporary difficulties, the only compulsion is to keep on servicing the interest component, till his situation permits repayment.

- In practice, without recourse: Gold loans are effectively given out on a “without recourse” basis. Although the fine print of the loan agreement incorporates the right of recourse to the other assets of the borrower, in practice, this is almost never enforced. Defaults are settled by sale of the pledged gold and losses (if any) are written off. There are no recovery agents to go chasing after the borrower and his other properties with threats of legal action, court orders etc. In contrast, in a typical “secured” loan from a bank, in addition to the primary security, you need to put up collateral and bring along a Guarantor who also gets hauled into court in case of default.

- No questions asked: People often borrow money on account of social compulsions which cannot be avoided in our cultural context; occasions like weddings, festivals, religious and social obligations etc. In this context, there is no denying that India’s banking sector continues to carry a hangover from the days of credit rationing that bank lending must always be for “productive” purposes. On the other hand, gold loans recognise that someone urgently in need of money cannot instead be made to settle for a lecture on wasteful consumption. Money is advanced solely on the criterion of the value of gold pledged and questions about the purpose of the loan would only be to confirm that anti-social or wildly speculative activities are not involved.

- Suited for the unorganised sector: Gold loans are ideal for those employed in the informal or unorganised sector and lacking documents to prove their incomes. This is a segment conventional banks generally avoid because their appraisal and credit scoring is based on formal documentation. Incidentally, more than 90 percent of India’s workforce is employed in the unorganised sector.

- Moral pressure against default: The recent success of the micro-finance sector has brought attention to the advantage of the group approach when lending to the poor. The loan is extended to individuals in a group and a default by any one member leads to the entire group being denied subsequent loans. Therefore, there is collective moral pressure on each member from the rest of the group to repay in time.

- Something like this is at work in a gold loan too. There is no group approach but the market practice that gold loans are generally extended against household used jewellery has a similar impact. The fact is, borrowers and their families are emotionally attached to their family jewellery. Very often, it would have been acquired during important occasions like a marriage or the birth of a child etc. Occasions of wilful default, particularly with intention to capitalise on fluctuations in gold prices, are few and far between.

- It therefore stands to reason that banks and financial institutions that choose to scale-up their gold loan portfolios would be able to do so with minimum risks. And, from a regulator’s perspective, gold loans can actually serve to minimise systemic risks.

- Gains for the wider economy: India has the world’s largest stock of privately held gold with informed estimates ranging from 15,000 to 20,000 tonnes of gold. When this gold is kept idle in our lockers and vaults, it is a drag on the Indian economy: it has the effect of keeping billions of dollars in savings (at a conservative price of $1,000 /oz., it amounts to about $480 to $ 650 billion) out of the financial system. This is a huge sum that otherwise could have been lent out to industries and for building infrastructure. When people borrow against gold (technically called “monetization”), the impact is to set in motion a whole new chain of economic activity boosting demand and consumption expenditure in the economy.

The road ahead

There is now increasing recognition that economic and social policies need to be rooted in reality, not in any visions of an ideal world. Today, the ground realities are that significant sections of the rural poor continue to lack access to banks, either to park their savings in, or as a fallback for loans in times of need. Also, given the country’s atypical cultural context, gold continues to play an important part in our lives, reflected in the fact that India is consistently the world’s largest consumer of gold. Under these circumstances, the organised gold loan segment is potentially a vehicle for social transformation. Considering that 65 percent of our massive private stock of gold is held by rural households, and that 75 percent of the gold loan market continues to be with the unorganised sector (local moneylenders and pawnbrokers), this is a market with tremendous potential for growth.

At the same time, there is an urgent need for the government and the regulators to recognise the professionalism and transparency that the organised sector brings to this field and encourage its growth. We need a radical shift in the regulatory approach, from one of tolerance with a multiplicity of hurdles, to that of facilitation and active promotion. A useful beginning can be made by not treating this sector on a par with local moneylenders and pawnbrokers. And, it will help if gold loans are not clubbed with other NBFC lending when prescribing regulatory capital.

The distress faced by India’s farmers in recent years highlights the need to move on multiple fronts in extending timely credit to the rural masses. Gold loans must be made a part of this process.

Note: An edited version of this article was published in the op-ed page of The Economic Times dated July 29, 2010 under the title “Gold Loans aid financial inclusion”.

Besides focus on the business, the cause of the wider community is central to the vision of the company. The Manappuram Foundation was established in October 2009 to drive the company’s initiatives in Corporate Social Responsibility (CSR). The major project of the Foundation is an original scheme, “Janaraksha Manappuram Free Health Insurance Scheme” extending health insurance to 20,000 Below Poverty Line (BPL) families in the seven Panchayats located around the Valapad Head Office of the Company. They are now eligible for free medical care up to Rs.60,000 per year along with cashless treatment at some of the leading hospitals in Thrissur District.

The Manappuram Foundation has set up the Manappuram Academy for Professional Education to impart free coaching for Professional Courses like CA/CS/ICWA, to bright students from low income households. The company was honoured with a 'Special Commendation' at the Golden Peacock Awards for Corporate Social Responsibility for the year 2014.

As a company focused on gold loans, Manappuram was prone to the concentration risk. Financial sector regulators in India have been expressing concern over the concentration risk inherent in the mono-line business model. To assuage their concerns, the company initiated bold moves to become a multi product company.

Over the last six years, the company has diversified into new business areas like microfinance, vehicle and housing finance, and SME lending. In February 2015, the company acquired Asirvad Microfinance Pvt. Ltd. with AUM a little short of Rs. 3,000 million. Today, six years of its takeover, AUM has around Rs. 60,000 million. Accelerated growth is reported in the other new business segments too. Our other new businesses — Commercial vehicle loans and housing finance loans —now contribute over Rs. 17,000 million to our total AUM of about Rs. 272.24 billion. Overall, non-gold businesses contributed 30 percent of the total business as of March 31, 2021.

| RS. IN CRORE | |||

|---|---|---|---|

| Particulars | FY 2020-21 (Mar 31, 2021) | FY 2019-20 (Mar 31, 2020) | % growth |

| Income from operations | 6331 | 5465 | 15.83% |

| Profit before tax | 2316 | 2007 | 15.38% |

| Profit after tax (After minority interest) | 1725 | 1480 | 16.53% |

| AUM | 27224 | 25225 | 07.92% |

| Return on Assets ( % ) | 5.6% | 5.9% | |

| Return on Equity ( % ) | 26.17% | 28.40% | |

Soon after it commenced its operations, the company gathered several “firsts” to its credit. The first non banking financial company (NBFC) in Kerala to receive a Certificate of Registration issued by the RBI, it was also among the earliest to go for an IPO in 1995. In 2007, it became the first Kerala based NBFC to receive investment from foreign institutional investors (FIIs) when the celebrated PE fund, Sequoia Capital, invested Rs.700 million along with Hudson Equity Holdings. Sizable foreign investment was received during two QIPS in 2010 when a total of Rs.12,450 million was raised. Manappuram Finance Ltd. was the first NBFC in Kerala to obtain the highest short term credit rating of A1+ from ICRA. In 2010, it became the first Kerala-based NBFC to offer ESOPs (Employee Stock Option Plan) to its middle and senior management functionaries.

As a pioneer and trailblazer, Manappuram Finance Ltd. has always been an innovator par excellence that enabled it to lead the way and stay ahead in the game.

Technology innovations: In the matter of technology, Manappuram was one of the earliest to adopt the “core banking” platform. This was no mean achievement considering that unlike the banking sector there were no ready-made software solutions for gold loans. It came about only because the company invested in developing its own proprietary solutions, and today its technology platform is one of its core strengths. The investment in technology has paid off in many ways, for instance, in streamlining procedures to reduce turnaround times in gold loan disbursal and in implementing advanced risk management practices as described below.

Critical to the success of a large scale gold loan business is the ability to weed out spurious and substandard gold at the pledge stage itself. The purity testing that is carried out essentially verifies the purity of the ornament at a particular point or two. It is not designed for 100 percent certainty. Moreover, the gold loans business emphasize speed and hassle free experience. Therefore, simplicity of procedure is also a must and a balance has to be struck. At Manappuram, advanced risk management practices were put in place that drew upon the promoter’s intimate understanding of the business. It was implemented through the IT platform which generates alerts to management upon any suspicious or abnormal transactions at the branches. For example, the gold loan business focuses on household used jewellery to which borrowers may be expected to have an emotional connect. When a branch accepts multiple numbers of the same ornament for pledge, it is more likely to be a local jeweller or pawnbroker and the system automatically flags the transaction for verification by internal auditors.

In keeping with its record of technology led innovations, the company launched its latest product “Online Gold Loans” in 2015. A customer who has completed the initial formalities can now avail a gold loan 24X7, from anywhere in the world, in fact, even as he sits at home. The loan proceeds are instantaneously transferred to his bank account. The concept is now proposed to be extended further with launch of a co-branded debit card that would allow even customers without access to bank accounts to withdraw the money from an ATM anywhere.

Product innovations: Manappuram has led the way in the matter of product innovations too. Gold loans were for long sold as a “one-size-fits-all” product. The company was a pioneer in introducing variety to it, for instance, by offering progressively higher loan amounts at higher price points. It was also the first to come up with “one-day interest” where borrowers have the option to settle a gold loan at their earliest convenience, even within a day, at a time when the norm was to recover a minimum interest of seven days, or even a month.

The most recent innovation is the launch of short tenured gold loans. Historically, all gold loans were sanctioned for one year and bullet repayments of both interest and principal was the norm. After the fierce correction in gold prices in 2013, gold loan companies were faced with higher defaults and profitability took a hit. Manappuram Finance Ltd. launched short term gold loans of three and six month tenure and today, the bulk of its gold loan portfolio has been shifted to the short term buckets. This has minimised price risk which is otherwise a major concern in gold loans.

Innovative approach to raising finance: For a non banking financial company (NBFC), raising funds was a big challenge in the nineties. In the aftermath of the CRB scam of 1997, raising deposits from the public was difficult and banks were not comfortable with lending to NBFCs in general. Moreover, Manappuram’s foray into gold loans was untested as a business model. Growth was slow in the initial days. The picture was to change only after the company hit upon unconventional ways to raise funds.

In the first breakthrough, Manappuram became the first gold loan company to raise finance through the securitization and assignment route in a tie up with ICICI Bank. The arrangement with ICICI Bank continued to work well for a few years and the company was put on the growth path. Buoyed by the success, the company planned a big expansion of the branch network. However, around 2006, ICICI Bank faced some regulatory hurdles regarding securitization and they could no longer fund the company. With ICICI Bank pulling out, the expansion plans were in jeopardy.

At this point, the company chanced to get its second break. Temasek, the sovereign investment fund of Singapore, was looking to expand its footprint in the Indian financial market. Mr. Nandakumar happened to be in Singapore to take part in a conference of NBFCs. Having heard Mr. Nandakumar speak about the gold loan business, Temasek expressed interested in financing Manappuram through their India arm Fullerton. Temasek’s debt participation provided the visibility, and paved the way for other international players to follow.

In December 2007, Manappuram became the first NBFC in Kerala to attract foreign institutional investment when the celebrated PE fund Sequoia Capital invested Rs.700 million together with Hudson Equity Holdings. Since then, the company has regularly received foreign investment. The second round of private equity funding in November 2008 was led by Ashmore Alchemy which, together with Sequoia and Hudson, put in another Rs.1,080 million. Sizable foreign investment was received during the two QIPS in 2010 when a total of Rs.12,450 million was raised. Once private equity came in, the company was able to shift gears and grow much faster than before because now even the PSU banks were willing to lend to it. From this point onwards, there was no looking back.

Conventionally, companies have sought funds from foreign investors after they have tapped the domestic banks and other financial institutions. In the case of Manappuram, the order was upended. Because the domestic banks were uncomfortable lending to NBFCs, especially one with an untested business model focused on gold loans, the company went out of India and roped in the foreign players first. Once they were persuaded, the domestic players became more confident about lending to the company.

Innovative Marketing Campaign with multiple celebrity Brand Ambassadors: Despite the vast amount of gold in private hands in India, the gold loan business is yet to grow to its true potential even today. There was a continuing stigma attached to pledging gold. Rather than use their gold to raise money, many preferred to go to moneylenders and borrow at exorbitant rates.

Manappuram has been proactive in tackling this sensitive issue head-on. It followed a strategy of a big-budget advertising campaign that revolved around celebrity brand ambassadors with strong regional appeal, who talked about gold loans to the masses in their own language. When the fashion was to use one celebrity brand ambassador for a nationwide campaign, Manappuram’s campaign beginning in 2010 had a galaxy of super stars like Akshay Kumar, Mohanlal, Mithun Chakravarty, Vikram, Venkatesh etc. and they were used to target different geographies; Mohanlal for Kerala, Akshay Kumar for the Hindi speaking belt, Vikram for Tamil Nadu etc. The campaign was successful in growing the gold loan category as a whole and benefits were reaped by players across the sector.

Manppuram Finance Ltd. is a professionally run company promoted by Shri V.P. Nandakumar who controls approximately 35% of the total equity of the company. A similar share is held by various Indian and foreign private equity funds while the balance is dispersed among the public. The shares of the company are traded on both the BSE and NSE. The company is managed by a Board consisting of eleven directors headed by Shri Jagdish Capoor, Chairman. Shri Capoor is a former Deputy Governor of the RBI. Shri V.P. Nandakumar is the MD & CEO of the company. In January 2017, he was ranked by Business Today magazine as one among the Top 40 CEOs from the BSFI sector. He was one of a select few corporate leaders from India to be shortlisted for the CNBC Asia Business Leader Award 2016 held in Jakarta in November 2016.

Over the next few years, Manappuram Finance Ltd. hopes to become a leading player in the financial services sector catering to the requirements of the mass market with a suite of products ranging from home loans, vehicle finance, microfinance, and MSME loans, besides its core offering of gold loans.

Vision

To become the preferred choice of financial services partner for India’s aspiring classes, meeting the full range of their credit requirements, and helping India become a financially inclusive society where every citizen has ready access to formal channels of finance.

Mission

Manappuram Finance Limited is dedicated to the mission of bringing convenience to people’s lives and making their lives easier. We offer secured and unsecured credit to meet their varied financial needs from instant gold loans to microfinance, affordable home loans, vehicle finance and more.

Values

- Integrity: At Manappuram Finance we value our reputation for integrity in our dealings. We set great store by ethical values and transparency. We take pride in following the laws of the land in letter and spirit.

- Unrelenting Customer focus: We treat our customers with the utmost fairness. No matter what their economic status is, we offer everyone prompt and courteous service, with high levels of transparency.

- Cutting-edge Technology: Technology is central to our vision. We continue to invest heavily in technology to enhance customer experience and drive efficiency in operations. We believe in tech-led innovations to deliver seamless and responsive financial services of ever greater value to customers.

ONLINE GOLD LOAN

With our new online gold loan facility, you can avail gold loan 24x7, from anywhere in the world!