By K Senthil Kumar

Manappuram Finance is one of India’s leading Gold Loan NBFC’s. We have experienced an immense history of unparalleled growth with many milestones achieved and our primary objective will always be to sustain and keep growing at a rapid pace. In the world of financing, with such arduous competition, continuously innovating, evolving and sustaining rapid growth are the key ingredients in establishing a significant hold in the credit lending market. As a pioneer and trailblazer, Manappuram Finance has always been an innovator par excellence that enabled it to lead the way and stay ahead in the game.

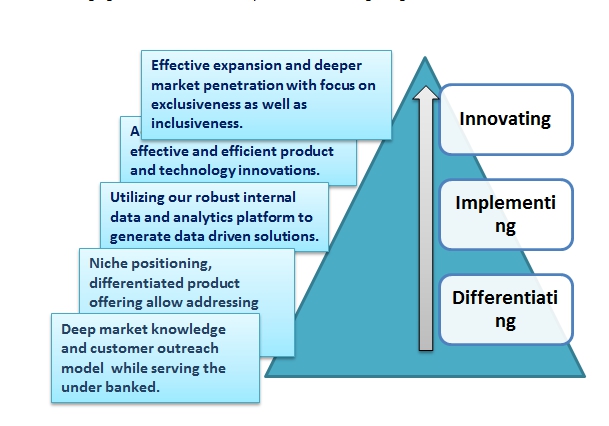

Our plan is to make Commercial vehicle financing in India more inclusive as well as exclusive at the same time. We want to expand on our existing products and services to the optimum extent, create a sense of exclusiveness for every product we offer to our different range of customers. Our major objective is to make customers realize we have something different to offer to them at every stage. We tend to make our plans very dynamic so that we can adapt to the socioeconomic changes efficiently.

Moreover, knowing the high level of competition already existing in this field, as we mentioned earlier, we would like to take lessons from our stories of unparalleled growth, generate more flexible, simpler and market capturing solutions and adapt to and implement effective product and technology innovations. We continuously explore various innovative approaches to raising finance; create further efficient solutions for customer on boarding and management through our services as well as maintain the growth and quality of our portfolio through several effective initiatives. For example, we are one of the first Commercial Vehicle financiers to use robust data analytics platforms on our internal as well as bureau database for evaluating customers through various behavioral and static scorecards. It is one of our firsts and hopefully we will keep building on such excellent initiatives and expand on our pool of solutions.

Our mantra has always been to incorporate a robust growth outlook, expand on our established and synergistic products and leverage on our strong brand equity and customer base. This mantra combined with our team’s willpower and effective implementation has helped us realize our true potential and future goals.

We already have a wide range of products on which we want to expand, have a deeper market penetration, both urban and rural. Knowing the potential of commercial vehicle financing market in our country and the rate at which it is growing, effective expansion and penetration is our key priority. Our focus will always be on empowering the unbanked segment, leveraging on the immense opportunities arising from the “last mile connectivity” segment through our expansive “hub and spoke model” and we are also looking forward to expand on our electric vehicles segment as well.

We are now living in an era where data has been coined as the new oil and innovations based on data driven decision making is being termed as an inexhaustible engine for growth. In today’s financial service landscape, business is driven by data. Data provides valuable insights for businesses to focus on key areas that need valuable resources such as people and money. Currently, anything and everything that happens in a financial sector generates data; The key takeaway? Data is helping the individual manage his/her work easier. Early warning systems help him achieve milestones in the application process on time and ultimately result in speedy loan origination and enhanced customer satisfaction.

Analytics can surely work as a refinery in generating efficient insights from the robust internal database and that gives you an edge over the others in foreseeing portfolio trends and taking decisions based on dynamic trends exhibited by our indigenous data. We have been currently utilizing our robust analytics platform to monitor and manage our customers from the point of on boarding, improving efficient collection mechanisms, predicting early delinquency scenarios and understanding various portfolio dynamics. Our goal is to move to automated decision making to a certain extent, since in the Commercial Vehicles industry, there exist a lot of externalities, it is never possible to have a fully automated data driven decision making. We have always efficiently adapted to technology and product innovations, so data driven decision making is another such innovation that we would like to utilize effectively in leveraging our opportunities.

We would always like to keep innovating, differentiating and implementing and hopefully we can keep challenging ourselves like we always have in achieving our goals.

(The writer is CEO - Vehicle and Equipment Finance division)