By V.P. Nandakumar

For all the scientific and technological progress the world has made, people continue to value gold for the feeling of safety and security that it provides. Even today, most retail buyers of gold would trust it more than the currencies of their home countries. In fact, 75% of retail investors in India trust gold more than the rupee.[1] In the last calendar year, the price of gold in India has risen 23.9%[2] against a backdrop of falling interest rates, economic uncertainty and geopolitical tensions. The international price of gold went up by 18.9%. Typically, a bull market in gold develops during times of global currency crises, a bull market in bonds (i.e[RS1] [SJ2] . falling interest rates), a commodities bull market, or a combination of all three.

The weak growth outlook for global economies has helped boost gold prices. Also, the reduction in interest rates effected by the US Federal Reserve and other advanced economies, and gold purchases by central banks in the emerging market economies, have also helped support gold prices. Recently, the Asian Development Bank lowered the growth forecast for China and other major Asian economies including India. Notably, China and India are among the two largest consumers of gold in the world.

At the same time, recent reports suggest that the ongoing US vs. China trade war may ease somewhat as the US has approved the phase[RS3] -one of the trade deal, which could reduce the uncertainty around global trade policies. The US has reportedly agreed to halve the tariffs on products worth $110 billion from 15% to 7.5%. Should this lead to optimism and a fresh wave of global risk-on trade, it can potentially weigh down on traditional safe-haven assets, including gold. However, sensitive issues such as indirect state subsidies, intellectual property and the Chinese ambition to dominate tech markets remain unresolved. Further, the upcoming 2020 presidential election is another uncertainty factor impacting policy risk.

US Fed’s balance sheet expansion

In December 2019, the US Federal Reserve Bank announced new term operations totalling $365 billion (over the two months upto January 2020), which involves ramping up the amount of temporary liquidity injections into the overnight lending markets. The Fed is to offer a total of $490 billion in liquidity via repo operations, including the $75 billion that it has already pumped in through three earlier term actions.

Historically, the Fed’s balance sheet expansion programs have boded well for gold. For instance, the initial expansion of the Fed’s balance sheet began in 2009 in response to the sub-prime crisis. At that time, the Fed’s balance sheet was below $1 trillion, but by 2014, it had increased to $4.5 trillion. From 2008 to 2011, the Fed bought $2.3 trillion of debt, sending gold prices to a record high. In fact, during this period, gold rose from $800 per ounce to $1,200, and peaked at a record high of $1,921 in September 2011. Note that prices fell from highs above $1,600 to $1,200 in the first six months of 2013 due to expectations that the US Fed would unwind its policy of monetary easing (the so called “taper tantrum”). All in all, there is a strong reason to anticipate a near term bullish move in gold on the back of Fed’s balance sheet expansion.

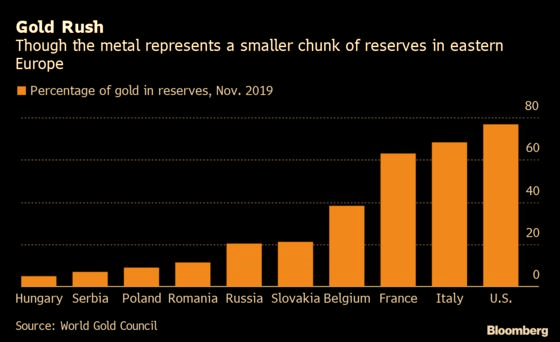

[Gold Is New Obsession for East Europe’s Nationalist Leaders]

Pricing of Gold

In some respects, gold is somewhat[RS4] like a super-sovereign, zero-coupon bond. It has an intrinsic value, and it is highly liquid, carries no risk of default and provides no yield. As such, the returns generated by gold depend on its underlying value rising over time. Much like bonds, the price rises as yields fall, a trend that was particularly evident during the two big US debt crises of the past 100 years, the Great Depression in 1929 and the Subprime Crisis in 2008.

The US authorities dealt with both crises in a similar fashion: they reduced short-term interest rates to around zero, thereby injecting liquidity into the financial system and depreciating the dollar against major currencies. Gold benefited from this policy on two counts. Firstly, as gold is priced and traded primarily in dollars, its purchasing power increased as the US currency weakened. Secondly, as interest rates fall, bond yields fell in sync. All this effectively reduces the opportunity cost of investing in gold which is a non-income-bearing asset.

To understand the relationship between the price of gold in US dollars and the US interest rate and inflation, one can think of gold as if it were a bond. Gold, in this sense, is like a zero-coupon bond (pays no interest), long duration (lasts forever), inflation-linked (demonstrated by historical purchasing power) and has zero credit risk (like a super-sovereign).

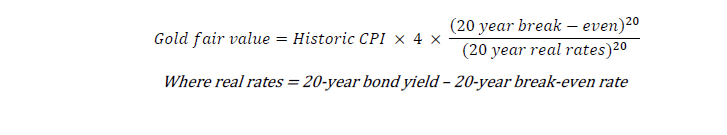

Charlie Morris, Head of Multi-Asset Atlantic House Fund Management created a gold valuation model[3], to value gold in US dollars, as a model of a hypothetical zero-coupon inflation-adjusted asset:

The number 4 is the calibration with the best fit using a regression model, and the 20-year duration derives from a volatility match. Gold’s long-term average volatility has been similar to 20-year US Treasuries. It is more volatile than the 10-year but less so than the 30-year. He overlaid the results of this calculation on top of the gold price and it seemed to explain the trend, fair value and medium-term movements.

Forecasts for Gold Price

The US Fed has cut short-term interest rates and most observers expect further reduction. There is even speculation in some quarters about more quantitative easing which would provoke another round of dollar depreciation. Bullion climbed to a six-year high in September 2019 as the Federal Reserve cut borrowing costs and the total pile of debt yielding less than zero rose to a record $17 trillion, boosting the appeal of non-interest-bearing gold. The question may now be asked, what is the outlook for gold in 2020? Here are the views of some important players in the market.

Citigroup believes that gold has got more room to rally as there’s little possibility of the Fed raising interest rates in 2020. With the risks to global growth tilted to the downside, with inflation still undershooting, and with trade tensions likely to persist through 2020, they believe the bar to cut rates and going back to policy easing is lower. Citigroup expects Gold Futures to average about $1,575 an ounce in 2020, with an upside bias. They do not expect the US policy rate to move higher, rather, the Fed is seen capping the rise in real as well as nominal medium-term yields, thereby reducing the opportunity costs of holding gold. All these factors should be supportive of gold price in the medium term. The most significant risk to gold prices in the near term is a surprise trade deal between the U.S and China and a substantial rollback of tariffs.

Goldman Sachs Group Inc. and UBS Group AG see prices climbing to $1,600 an ounce (a level last seen in 2013). Gold is likely to have specific periods of outperformance when the market goes risk-off (i.e. when negative sentiments dominate and inhibit risk-taking). While most see a prolonged pause from the Fed, there are dissenters too. BNP Paribas SA expects another two rate cuts in the first half of 2020. The low-yield environment, along with the anticipated weakening of the dollar and easy money policies, will continue to support gold. Bullion buying by governments has emerged as a major pillar of demand, and this includes purchases by China. Goldman Sachs says the case for diversifying into Gold is ‘as strong as ever’ as central banks are consuming a fifth of the global supply of gold, marking a shift away from the dollar that’s bolstering the case for owning bullion. Demand for gold from central banks is the highest since the Nixon era (i.e. early seventies). Investors are therefore being advised to diversify their long-term bond holdings by including gold because of “fear-driven demand” for the metal.

BNP Paribas SA expects gold to surge above $1,600 an ounce as the Fed embarks on a quartet of interest rate cuts to combat slowing U.S. growth, the fallout from the trade war with China, and diminished prospects for any significant pick-up in inflation in the coming months. It expects the US Fed to opt for four 25 basis point cuts between now and June 2020. As nominal yields fall with each reduction, real rates will head towards negative territory, increasing the appeal of holding gold.

On the other side, Morgan Stanley believes that a rollback in the tariffs imposed by the U.S. and China against each other could see gold prices falling[RS5] toward their bear case forecast of $1,394 an ounce in the first half of 2020. Further, Chinese consumers are shunning gold as they grapple with the slowest economic growth since the early 1990s. China’s imports of non-monetary gold in October 2019 slumped to the lowest level since January 2017. Demand in India is also relatively depressed, and was unusually weak during the Diwali festival that otherwise sees a bump in imports. Accordingly, there is little reason to expect a rebound in consumer demand for gold anytime soon, and should investment demand begin to wane too, the continuation of the gold bull run will be at risk.

To sum up, there is no way one can confidently predict what the price of gold would be in 2020. Analysts can, at best, try and predict the likely reaction of gold price in case specific events occurs. There is no denying that the global economy is yet to recover fully from the financial crisis of 2008-09. While the US is showing signs of strength, Brexit can possibly set off fresh tremors across global markets. The yield on more than one-third of global debt is in negative territory. The trade war is far from over, and with US presidential elections in November 2020, there is more uncertainty to come. In a nutshell, while gold prices may see some easing in 2020, a sharp correction is less than likely. Moreover, there are several known unknowns that may nudge markets towards risk-off leading to the continuation of the gold bull run. At the end of the day, however, your guess is as good as mine.

Published in Unique Times Magazine, January 2020

(V.P. Nandakumar is MD & CEO of Manappuram Finance Ltd. Views are personal.)