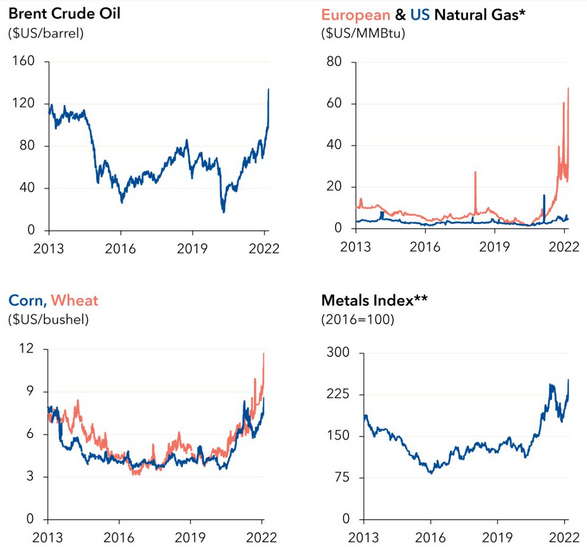

On 24 February 2022, Russia began a military invasion of Ukraine in a major escalation of the Russo-Ukrainian conflict that has been simmering since 2014. Denounced by the US and its allies as a war of aggression, it is the biggest military conflict in Europe since World War II. Russia's economy is only the world's 11th largest with a GDP of about $1.5 trillion but its vast oil and gas resources and its status as a leading producer and exporter of metals and other commodities makes it an important player in world trade. As Western sanctions on Russia tightened in response to its invasion of Ukraine, it disrupted the country’s oil sales. Crude prices surged to over $139 a barrel in March 2022, the highest levels since 2008, aggravating global inflation already running hot after the pandemic-induced disruptions to the global supply chain. In Europe, the price of wholesale natural gas spiked to new highs which will further exacerbate inflation and slow down growth to give rise to fears of stagflation. It also makes the task of global central banks trying to cool inflation a lot more difficult. The crisis is also putting more stress on the already stretched global supply chains. And should the war continue for much longer, things could get a lot worse.

The sanctions imposed on Russia

Russia’s invasion of Ukraine has drawn a harsh response from the US, the UK, the European Union, Canada, Japan, Australia and some other countries. Severe sanctions have been imposed by the western powers on Russian companies, banks, oil and gas sector etc., that have drastically altered the rules of the game for the global economy. The effect has been to isolate Russia from global financial and trade networks, thereby bringing about a collapse in the value of its currency and financial assets, and sending energy, metals and food prices soaring.

Further, it has led to an exodus of leading international companies from Russia. From the tech giants to automobile manufacturers, retailers and airlines have all suspended their activities in Russia. Container shipping lines have cut down their services. Visa and Mastercard have decided to walk out of Russia and their cards don’t work anymore in the country, leaving millions unable to make payments using these cards. Boeing and Airbus will no longer service Russian airlines. The exclusion of Russia from the SWIFT payment system, the freeze on Russian assets, and denial of new funding is likely to affect about 70-80% of Russia’s banking system.

The sanctions have cut off Russia's two largest banks, Sberbank and VTB, from the market for US dollars. Seven Russian banks (including VTB) have been removed from SWIFT, a global messaging service that connects financial institutions and facilitates rapid and secure payments. The Western powers are trying to prevent Russia's central bank from selling dollars and other foreign currencies to defend its currency (the ruble) and its economy. In total, nearly $1 trillion worth of Russian assets have now been frozen by sanctions. However, while the war and its backlash inflict havoc on Russia, the repercussions are also being felt around the world. Even before the invasion, the global economy was faced with multiple stress factors such as surging inflation, supply chain bottlenecks, volatile stock and bond prices etc.

Impact on the global financial system

The potential impact of the sanctions on the world outside Russia has apparently not been fully acknowledged. The fact is that the economic consequences will go well beyond the price we pay at the petrol pump. Back in the days of the global financial crisis of 2008, most risks were contained within the banking sector. However, while the banks look to be in good shape today, more shadowy risks have emerged elsewhere, that put at risk even the closely regulated parts of the financial system. We are at a stage where the world is awash with the free money let loose by central banks to keep their economies afloat after the 2008 collapse. Consequently, given how asset prices have inflated into the bubble territory, and how debt levels have risen to new highs, we may be more vulnerable than we think we are. The global economy is now more inter-connected, and harsh sanctions that keep out Russia from the international economy can have unexpected consequences leading to a slowdown in growth and higher inflation.

The impact will be felt through three channels. Firstly, as prices for commodities like food and energy increase, inflation levels that are already high will go up even further. As income gets eroded by inflation, demand will fall. Secondly, European countries, especially those bordering Russia and Ukraine, will have to deal with a host of issues and challenges arising from disrupted trade, supply chains, and remittances, as well as a surge in refugee inflows. Thirdly, the blow to business confidence and the heightened uncertainty for investors classes will weigh on the equity markets giving rise to a risk-off sentiment which can potentially lead to outflows of capital from emerging markets.

Oil importing countries will experience higher fiscal and trade deficits that contribute to inflation. With food and fuel prices going further up, it may spur unrest in third world countries from Africa to Latin America to Asia and beyond. Ukraine and Russia together account for about 29% of all wheat exports. Wheat futures have spiked, making the commodity more expensive for producers of food products who will now be forced to pass on the costs to consumers. For India, the unwelcome news is that palm oil prices have also gone up as markets scramble to find alternatives to sunflower oil for which Ukraine has been the major supplier.

European governments are likely to face additional fiscal pressures from having to spend more on energy security and on upgrading their military and defence forces in light of the new security challenges. Eastern Europe is likely to see rising financing costs and a surge in refugees having absorbed most of the 3 million people who recently fled Ukraine. The sharp increase in costs for essential commodities will make it harder for policymakers around the world to strike a balance between containing inflation and supporting the economic recovery after the pandemic shocks.

Source: IMF

Risk to the petrodollar

Further, it is not inconceivable that the US led sanctions on Russia may bring forward the decline of the petrodollar system in place since 1973 and which has propped up the US dollar’s status as a reserve currency. The petrodollar system is an arrangement under which oil producers sell their output to the US and the rest of the world for dollars. Thereafter, these countries recycle the proceeds back into dollar-denominated assets parked in the US, especially US treasury and corporate debt. So far, this arrangement has supported the USD as the world’s reserve currency by creating an artificial demand for dollar and contributed to the US position as the world’s leading financial power. However, now there are credible reports that leading oil exporters such as Saudi Arabia are in active talks with Beijing to price some of its oil sales to China in yuan. If this move bears fruit, it can undermine the petrodollar’s dominance of the global petroleum market and, in turn, the entire global financial system that runs on dollars. Bear in mind that in recent years the US has relentlessly taken advantage of the dollar’s reserve status by printing as much currency as needed to fund their high deficits, effectively a debasement of the currency. China buys more than 25% of the oil that Saudi Arabia exports and if this were to get priced in yuan, it will boost the Chinese currency’s international standing and put it on a path to becoming a global petroyuan reserve currency to rival the US dollar.

Impact on the US Fed’s inflation fight

The US Federal Reserve raised interest rates on March 16 by a quarter percentage point and signalled its intention to hike rates at all the six meetings remaining in this year. “The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity,” a statement released by the Fed’s rate setting committee said. The Fed faces the difficult task of combating high inflation while ensuring that growth does not suffer. If the Fed were to go too slow with the tightening, it runs the risk of allowing inflation to get out of hand, which would necessitate even more painful action down the line. Tighten too aggressively, and it risks displeasing the markets and tipping the economy into a recession. The Ukraine war has sent the cost of fuel, food, and metals higher, raising fears of 1970s-style stagflation with heightened risks to prices, growth, and financial-market stability. While the war need not deter the Fed from sticking to its goal of taming inflation, it does reduce the visibility on the likely outcomes of its policy actions. In other words, it diminishes its ability to make accurate forecasts as the margin of error increases.

Consumer price inflation stood at a four-decade hight of 7.9% in February compared to a year ago. The Fed is now convinced that it must make borrowing more expensive to squeeze out high inflation before it gets entrenched in the consumer psyche. The war in Ukraine fuels inflation with higher energy and grain prices as also higher prices for commodities including metals. It elevates the risk of a sharper economic slowdown than what the Fed would have bargained for. The prospect of a recession is likely to cool down the Fed’s appetite to push up rates quickly. The war also complicates the Fed's stance on reducing its $8.7 trillion balance sheet which would have the effect of sucking liquidity out of the financial system. Ideally, it would prefer to announce a plan with adequate advance notice to the markets but if the war were to cause major revisions in the outlook for growth, the Fed would be forced to act in real-time thereby setting off jitters in the market.rnImpact on India’s economy

Last week IMF warned that the global economic fallout of the war in Ukraine is expected to negatively impact India's economy through several channels which would differ from those that affected us during COVID-19. The sharp rise in global oil prices represents a significant trade shock with macro-economic implications. It will lead to higher inflation and higher current account deficit. India's macroeconomic fundamentals remain strong, but the unfolding global developments pose additional risks from the spillover, RBI noted in its recent monthly bulletin. The spiralling oil and gas prices and unsettled financial market conditions also pose fresh headwinds to the still incomplete global recovery, it observed.

rn

The expected hike in crude oil will increase petrol and diesel prices resulting in higher overall inflation as manufacturing and transportation costs become expensive. As Russia was the leading global exporter of fertilisers, the sanctions have led to a spike in fertiliser prices. The price of urea (the most widely used fertiliser in India) and diammonium phosphate (second most widely used) have more than doubled from a year ago, according to Bloomberg data for India. Fertiliser prices had seen a steep rise in 2021 because of the increase in gas prices (natural gas is a feedstock for fertilizer production), strong US demand, and supply constraints. The current disturbances have provided an additional fillip to prices. In India’s case, much of this burden is borne by the government which absorbs the increase via higher subsidies to protect the agriculture sector.

Analysts conclude that the impact on India’s economy will be felt mostly through higher cost-push inflation weighing on all economic agents—households, businesses, and government. According to Nomura, every 10% rise in crude oil prices leads to a 0.4 percentage point-rise in consumer inflation. It increases import bills and widens India’s current account deficit (CAD). India’s CAD is expected to go up to 2.6% of the GDP in FY 2023, up from 1.7% estimated for FY 2022. This is likely to depreciate the rupee which recently plunged to a record low of 76.98 to a dollar. Consequently, there are good reasons to believe that India’s GDP growth will likely be lower while inflation runs hotter than the RBI’s estimates. That, in turn, points to the likelihood of a contraction in corporate earnings.

rn

The Economic Survey 2022 estimated India’s GDP growth rate at 8.0 to 8.5 per cent in FY 2022-23, which assumes crude oil prices in a range of US$70-$75 a barrel. Today, with crude oil trading at prices well above US$100 per barrel, many sectors of the economy will be negatively impacted. The rising import bill will put pressure on the Indian Rupee and make imports more expensive adding to inflation. According to estimates provided by Economic Survey, an increase in global crude price by US$10 lowers GDP growth by 0.3 percentage point. Therefore, India’s GDP growth estimates for FY 2022-23 are due for some downward revisions.

Some opportunities too

India’s wheat exporters are looking at unexpected gains from the Russia-Ukraine war as prices have skyrocketed amid sharply reduced supplies. As India may have an exportable surplus of 11-12 million tonne of wheat after meeting domestic requirements, we can look at close to US$5 billion worth of wheat exports in FY 2022-23. Given our bumper harvests and overflowing stock levels, farmers would benefit from the higher shipments as much as traders. The crisis is helping Indian farmers to skip government procurement at minimum support prices (MSP) and go with the higher rates offered by private players. More private interest and less government purchase is beneficial for the Centre because it otherwise provides compensation (subsidy) to the states for the economic cost of procurement. This is also a better deal for farmers who otherwise would have to sell their produce at MSP.

Western sanctions on Russia have prompted many countries and companies to boycott its oil and gas. This has forced Russia to sell crude oil at deep discounts to ruling international prices. To capture this windfall, Indian refiners are floating tenders to buy discounted oil from Russia. For example, the Indian Oil Corporation recently bought three million barrels of Russian crude for May delivery at a discount of USD 20-25 a barrel. With imports making up for 85 per cent of India’s oil needs, it is now looking to contain spiralling energy bills through such purchases. Given India's relatively neutral stance on the war, Moscow's offer of oil and other commodities at discounted prices will provide relief on the fiscal front. Also, with the European Union being the biggest market for India’s exports, the supply disruptions to the EU are likely to generate greater demand for steel, engineering goods etc., for which India is an alternate supplier.

In conclusion, it may be noted that should the war drag on, the consequences for the global economy will be quite severe with high inflation and slowing growth giving rise to stagflation. It is therefore to the advantage of all concerned that a ceasefire is promptly declared, and talks begin in earnest to arrive at a compromise that would take care of the essential interests of all sides in the conflict. The sooner peace is restored, the better it will be for the world, especially the third world countries whose people stand to suffer the most from higher food and energy prices.

Published in Unique Times Magazine, April 2022

(V.P. Nandakumar is MD & CEO of Manappuram Finance Ltd. Views are personal.)