Now that 2018 is here, it is time again to take a look at gold prices, how they have moved in the year gone by, and what is likely to happen in the current year. Making predictions about gold prices is never easy because unlike other commodities where prices are driven by demand and supply, gold is also ultra-sensitive to international economic and political trends of the day. And that is why predictions by experts and industry insiders about where gold is headed often turn out no better than the layman’s stray opinion.

Last January, in these very pages, I had said that gold was more than likely to hold its own, and with an upward bias. This was when the overall mood was one of pessimism, with gold having surrendered much of its gains during 2016 following shock events like Brexit and Donald Trump’s victory. My view was based largely on expectations of aggravated political uncertainties, doubts about whether the US Federal Reserve would be able to go ahead with interest rates hikes, and the fear of inflation resurfacing in the US with an expansionary fiscal policy under President Trump. As it turned out, the US Fed did succeed in pushing through three interest rate hikes, political tensions were no worse than in 2016, and US inflation continued to rule below 2 percent. However, the prediction that gold price would move up turned out to be true with gold price having gained nearly 13 percent in 2017.

A recap of gold price movement in recent years

The international price of gold experienced a steady and continuous upward trend from US $271.04 per troy ounce in 2001 to its all-time high price of around USD $1,900 per troy ounce September 2011. Thereafter, gold price remained range bound for some months and subsequently started declining steadily from 2013 to reach USD $1,060 by the end of calendar year 2015.

Here is a tabular summary of gold price movements in the international markets over the last five years.

| Calendar Year | Opening | High | Low | Closing | % Change |

| 2013 | 1,658 | 1,694 | 1,192 | 1,205 | -27.3% |

| 2014 | 1,205 | 1,385 | 1,142 | 1,206 | 0.1% |

| 2015 | 1,206 | 1,296 | 1,049 | 1,060 | -12.1% |

| 2016 | 1,060 | 1,366 | 1,060 | 1,146 | 8.1% |

| 2017 | 1,146 | 1,346 | 1,146 | 1,291 | 12.7% |

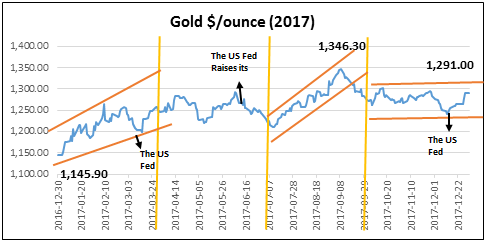

The year 2016 was marked by unusual volatility (at one point gold was up 26 percent only to close the year with a more modest 8 percent gain) due to one-off events like Brexit and the shock of the Trump victory in the US. In contrast, 2017 was much more subdued with gold up by 17.5 percent at the peak and closing the year with a net gain of 12.7 percent.

What, then, were the key factors that mattered for gold in 2017? Here is a summary in two parts, with factors that supported gold and factors with negative impact listed separately.

Factors that supported gold price in 2017

US Fed rate hike: The US Federal Reserve raised its key policy rate three times in 2017, in March, June and December. Strictly speaking, when US interest rates go up, gold should fall as an alternative safe investment becomes more attractive. In this case, although the Fed raised interest rate three times, it fell short of the hawkish expectation of four such rate hikes. Moreover, following the latest hike in December, gold price increased because of uncertainty over the pace of rate hikes in 2018.

Political uncertainty: The German elections in September 2017 led to re-election of Chancellor Angela Merkel with sharply reduced vote share making government formation difficult. (In fact, even as we have come to the end of January 2018, talks are still going on regarding the next government formation.) The political crisis in Spain over the demands for secession of Catalonia may result in early election in 2018, while the political uncertainties in Saudi Arabia following the anti-graft drive, and the US standoff with North Korea, all worked in favour of gold.

Depreciating dollar index: The US dollar depreciated against major currencies in 2017. The dollar index, which measure the strength of US currency against a basket of other major currencies, depreciated by 9 percent in 2017, recording its biggest annual loss since 2003. The dollar index and the price of gold share an inverse relationship and it is no surprise that gold price ended the year with gains of 12.7 percent.

Factors that held down gold in 2017

Deprecating Yen: The re-election of Japanese PM Shinzo Abe in October 2017 — widely expected to continue ultra-loose monetary policy with further depreciation of the Yen against the US Dollar on the cards — affected gold price. Since gold has a well known inverse relationship with the Dollar, the impact was negative for gold.

The US Tax reform: The introduction of the US tax reform bill which proposed cutting corporate income tax from 35 percent to 20 percent starting in 2019 further strengthened interest in US equities. The bill was subsequently passed by the US Congress and signed into law by President Trump on December 22, 2017. When alternative investment classes become more attractive, the impact is negative for gold price.

Recovery in Global economy: The gradual recovery in the global economy especially across the major advanced economies improved trade and capital flow. This resulted in increased risk appetite with money flowing away from safe haven assets like gold and into high risk, high return assets like equity, bonds etc.

What analysts expect for 2018

Uncertainty in any form benefits gold in its role as a hedging instrument. In predicting the future price of gold, analysts are as usual a divided lot. Some have cautioned investors about a potential decline while others are bullish for 2018. Various commodities analysts predict gold price to remain range bound between levels of US $1200 to US $1350 an ounce in 2018. Some of the prominent forecasts for 2018 made towards end of 2017 or beginning of 2018 are given below:

Goldman Sachs sees a negative six percent return from precious metals in 2018, and expects gold price to reach $1,200 per ounce by mid-2018. Bank of America Merrill Lynch sees only limited room for rise in gold prices in 2018, due to challenging macro-economic outlook for bullion. However, the company notes that a surprise in the inflation data could bring buyers back into the gold market. It estimates gold price of $1,326 per ounce in 2018. JP Morgan’s 2018 Global Commodities Outlook sees gold prices averaging $1,295 an ounce in 2018, with levels going up only in the second half of the year to $1,340. Citigroup estimates the gold price will climb to $1,350 per ounce in 2018. Royal Bank of Canada says 2018 should bring some "measured improvements" for gold prices starting with the seasonal trend of rally in precious metals early in the first quarter. The bank forecasts the average gold price in 2018 to be $1,303 per ounces.

Interestingly, at the time of this writing (end of January 2018), international gold prices have already rallied to levels of US$1,340 per ounce. The question remains, however, whether the gains will hold for the rest of the year.

Our view - Positive on gold, not so for the US economy

During calendar year 2017, gold gained nearly 13 percent in dollar terms, its best year since 2010. This came about even as equity markets regularly closed at all-time highs, and despite three Fed Funds interest rate hikes (taking the rate from 0.75 to 1.5 percent). Gold’s good performance during the last calendar year is best explained by the term “the Fear Trade”. The Fear Trade is driven by low to negative real interest rates (after accounting for inflation), high levels of deficit spending, weakening US Dollar and geopolitical uncertainty.

When predicting gold prices for 2018, I would say these forces will intensify during the year. With US inflation finally showing signs of an uptick and President Donald Trump's $1.5 trillion tax reform law expected to further increase US deficit spending, calendar year 2018 could provide the right conditions to nudge gold prices higher. Further, there are risks inherent in the US Fed’s stated goal of monetary policy tightening. (The historical record of past rate hike cycles in the last 100 years shows that only 3 such cycles out of at least 18 did not end in a recession.)

Let me conclude with a look at some other factors likely to hold up gold prices.

Flattening yield curve signals vulnerability: The recent flattening of the yield curve in the US is a noteworthy development. The yield curve is said to "flatten" when the difference between the two-year Treasury yield and 10-year Treasury yield starts to narrow. As of today, that spread is about 0.5 percentage points, its flattest level since October 2007. This measure is worth watching because it's often seen as one of the most reliable predictors of recession. The past seven US recessions were directly preceded by an inverted yield curve (when short-term yields rose above long-term yields). While we still have some distance to go before the yield spread actually “inverts,” the current flattening may be an early warning signal.

Inflation: Another factor that drives gold prices is inflation. When inflation erodes government bond yields, investors tend to seek more attractive stores of value, including gold. This is at the heart of gold's Fear Trade. In this context, official measures of US inflation have been low according to the official consumer price index (CPI). In 2017, the CPI just barely met the Fed's 2 percent target rate. However, economists using alternative and broader measures of inflation, such as the underlying inflation gauge (UIG) introduced last year by the New York Fed (which includes not just consumer prices but also producer prices, commodity prices and financial asset prices) report higher inflation. Whereas the November CPI came in at 2.2 percent, the UIG rose by 3 percent, its highest reading since August 2006.

The implications are important. Three percent inflation is higher than the five-year Treasury yield, currently around 2.5 percent, and the 10-year yield, about 2.5 percent. It's even higher than the 30-year Treasury yield at 2.7 percent. When market players eventually take notice that their money invested in government bonds doesn’t keep pace with inflation, the investment case for gold becomes more attractive.

US equities may be due for correction: For the moment, US equity markets have scaled new peaks following the passing of Trump’s tax plan. However, the expectation is that that this high will be short-lived. Most economists believe the Trump plan is unlikely to stimulate much economic growth without massive infrastructure spending. Further, official estimates say that the tax plan will add $1.47 trillion to the deficit. Not surprisingly, many analysts are predicting that that the party in equities will get over soon and investors might be in for a rude awakening. A fresh move by investors into gold as a safe haven asset may not then be too far away.

Published in Unique Times, February 2018

(V.P. Nandakumar is MD & CEO of Manappuram Finance Ltd.)