By Rajiv Rathinam

Fast-growing Adoption of Smartphones and increased internet penetration has created an ecosystem that enables consumers to embrace digital technology across multiple areas of their life. One of the most embraced activities is shopping online for goods and services.

Similarly, an area that is seeing a significant shift in consumer behavior is banking, the second most cited online activity among our survey participants. 86 percent of consumers, who have access to internet-enabled mobile or desktop devices, said they conduct personal banking online, with that number being higher in countries with a well-established digital banking environment, like Australia, Hong Kong, New Zealand and Singapore, as well as fast-growing countries like India. Despite the fast-growing adoption of digital channels, there are striking differences across the region in terms of digital readiness and capability. In emerging Asia- Pacific, government agencies and businesses are looking to improve the physical and regulatory infrastructure and availability of skilled talent and thus, tackle challenges surrounding financial inclusion, access to basic services and cyber-security. Traditional payments methods, such as cash-on-delivery, still dominate but change is underway.

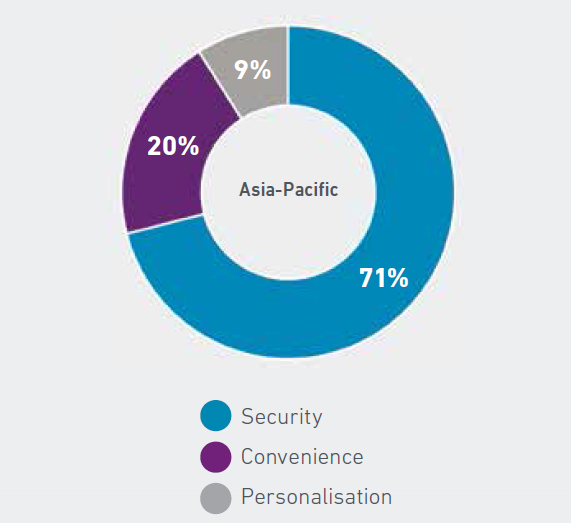

Security is the most important element of a consumer's online experience

The rapid pace of digital adoption is largely driven by the millennial population and affluent members of society. As more consumers come online and establish new habits, businesses can benefit from the cost and reach advantages that digital services offer. Unlocking the benefits of new digital lifestyles will be rewarding for businesses and consumers, but is not without challenges.

Consumers have higher than ever expectations, at the same time, digitally transforming service attract the risk of online fraud.

50 percent of businesses surveyed in Asia-Pacific region have seen an increase in fraud losses over the past 12 months in the form of account misused account takeovers, both potentially damaging to the Organizations Brand and Reputation. In India the Frauds reported stood at 65 percent and Hong Kong Being the lowest 34 percent. Fraud is a major concern as the reputation damage from Fraud can put the existence of our business at stake.

Government agencies and industry collaboration in Asia-Pacific are a driving force in making online activities more secure:

In India, government agencies, such as the Reserve Bank of India (RBI), are approaching consumer online security in a proactive manner. RBI has been diligently putting measures in place to ensure that digital transactions in India are protected, for example, by making two- factor authentication and static step-up authentication mandatory online protection measures. In addition, regulatory bodies in India have reprimanded large industry players in the past 12 months for unauthorized use of personal data, sending a message to Indian consumers that there is someone looking out for their online security and Protection.

Sixty percent of consumers place a high level of trust in banks and insurance companies in handling their personal data, followed by government agencies (57 percent) and payment service providers. Trust in Banks and Insurance Companies are the Highest in India.

Digital adoption and with it a fast-growing digital ecosystem are changing the relationship between businesses and consumers in Our Country. While businesses are striving to drive and unlock the benefits from increasingly digital lifestyles, they must tackle many challenges. Customers like to be recognized and expect to be met with a personalized experience at every interaction. At the same time, the growing sophistication of cyber-attacks including online fraud requires a matching response to guarantee the safety of personal data and safeguard businesses’ reputation.

Faced with these challenges, what can businesses do to deliver both the security and convenience consumers expect?

It may begin with a business’s ability to identify its customers and deliver relevant, convenient experiences without increasing their risk exposure by demanding more from the information it already accesses.

Digital identity programs that create a “single source of truth” and provide businesses and government agencies with verified customer digital identities are key in balancing security and convenience for online transactions.

Creating transparency regarding how businesses use their customers’ information and investing in the right technology for fraud management and safe customer authentication can go a long way toward creating more trust.

As consumers feel strongly about how businesses use their personal data, businesses that are transparent and use the data to increase customer security and convenience can be particularly successful in establishing customer trust.

Businesses have to start embracing advanced customer authentication methods, for example, those, that leverage biometric data, will fare well once consumers start to gain experience with them.

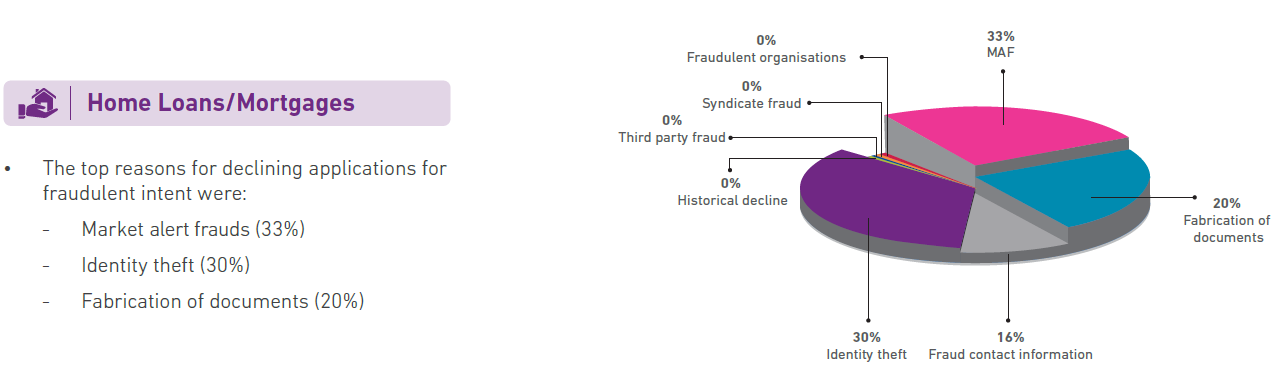

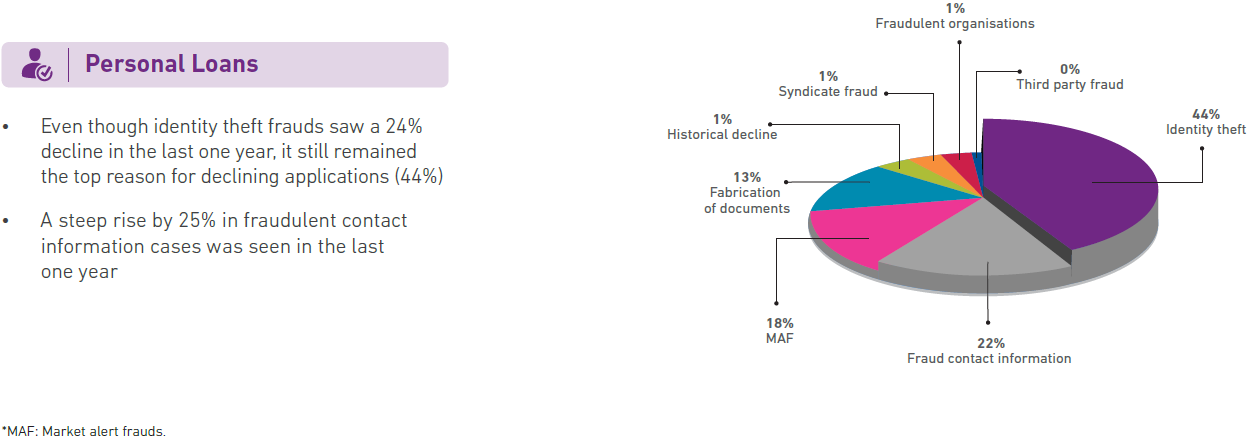

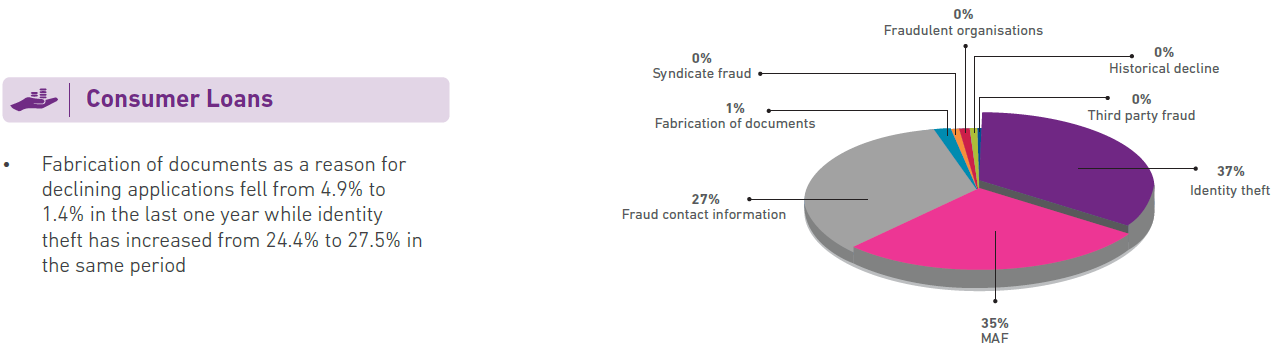

OVERALL FRAUD TRENDS IN INDIA

What does it take to build customer trust? Will be the next Big Question that Every Staff of Ours Will Need to think and Measure Up to.

(The writer is GM – Fraud Control)