Summary:

With investment in the equity markets being the flavour of the month, perhaps this is the right time for a gentle reminder why gold continues to be a relevant investment option and not be relegated to an afterthought.

Gold in India

India is the largest consumer of gold in the world. Our love affair with the metal is age old. Roughly 800 to 900 tonnes, about a third of the total gold mined in the world, is consumed in India. Domestic production being negligible, we are the largest importers of gold. Gold is rare, beautiful and stable. It does not depreciate in value, nor deteriorates in quality with time. It acquired a social, emotional and economic significance beyond logical comprehension. Many of our traditions have changed over the years, but large scale purchases of gold during weddings and festivals continue. Moreover, gold has unfailingly stood as our saviour in times of financial turmoil when real estate, stocks and commodities have crashed.

According to a recent nationwide debt and investment survey, an average Indian household holds 84 percent of its wealth in real estate, 11 percent in gold and the remaining 5 percent in financial assets (such as deposits and savings accounts, equity shares, mutual funds, life insurance and retirement accounts).

Investing in gold

Given the importance of gold in India, it is not surprising that it enjoys pride of place in the common man’s investment portfolio. After all, it is one of the safest avenues for investment, equivalent to bank deposits that, additionally, has offered better protection against the ravages of inflation. Over the last decade and a half, gold has delivered fairly high returns when compared to other risk free investments. Throughout history, gold has been regarded as a store of value, known to provide risk free real returns especially when inflation is up. For example, the average consumer price inflation during the three high inflation years from FY2011-12 to FY 2013-14 was nearly 10 percent. Fixed deposits with banks during this period gave negative inflation adjusted returns whereas the price of gold in India went up by 38 percent to deliver positive real returns. Internationally, the yellow metal has outperformed the S&P 500 since the beginning of the century, returning 86 percent more than the market according to the World Gold Council.

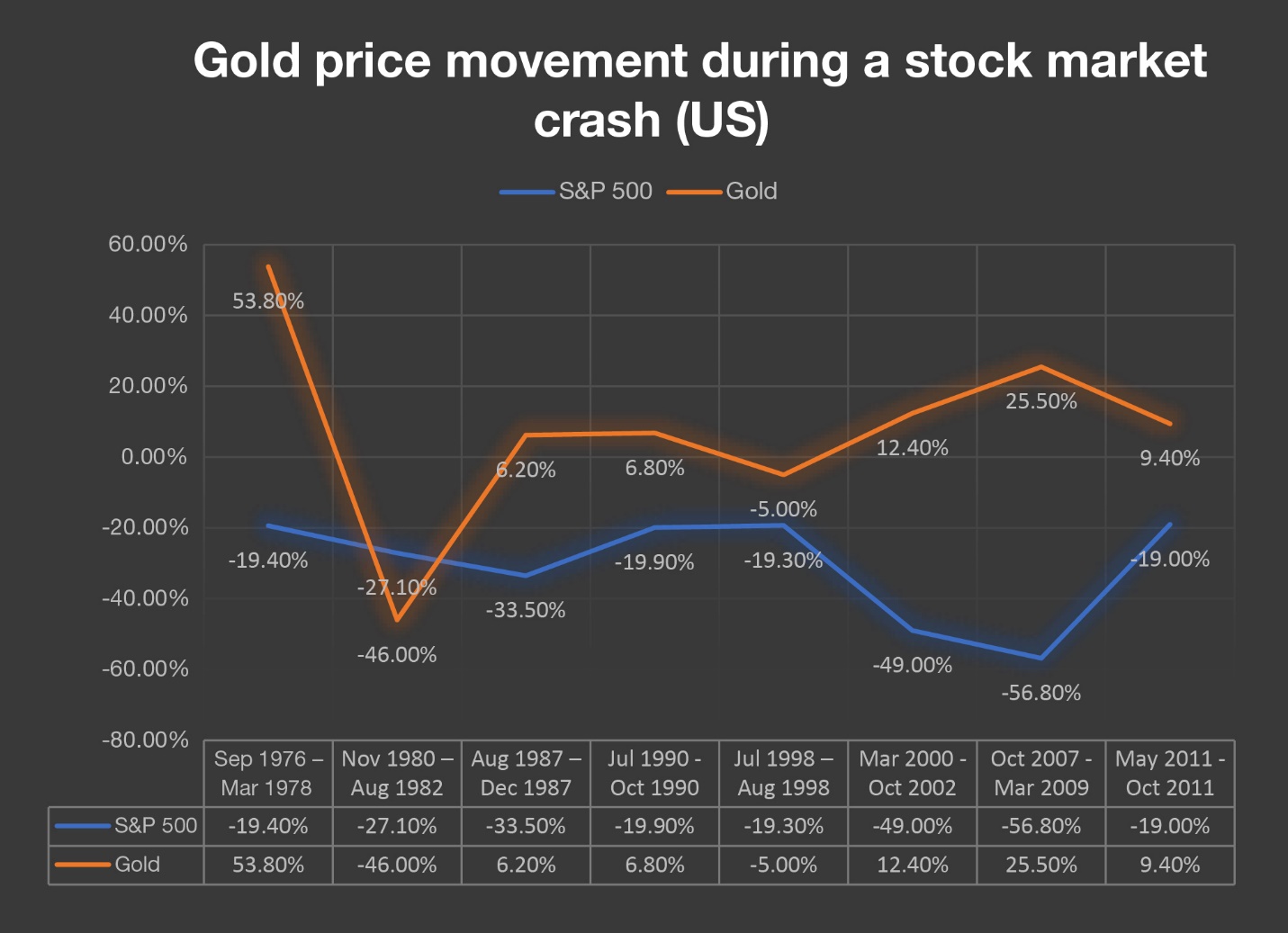

In India, the recent boom in the stock market has delivered handsome returns to seasoned traders and it has now lured less experienced retail investors to jump onto the bandwagon. While the returns have been high, it also comes with a fair amount of risk. And so, to protect one’s hard-earned savings, professional investment advisors often recommend investment through mutual funds which diversify risk on behalf of individual investor. But then, the common investor is confused by the array of mutual funds offering diverse categories and literally hundreds of schemes to choose from. Homing in on the right stock or mutual fund to buy into is not easy, and keeping track of its price movements is another hassle. Interestingly, when stock markets are trading at historical highs (both in India and abroad), and when the fears of an impending correction appear plausible, gold makes an excellent case for stepped up investment. After all, it is a general observation that when stock markets collapse during periods of economic woes, gold price often heads up in keeping with its status as a safe haven investment. The below table indicates how the international price of gold moved during eight periods of the biggest decline in US stock market over the last four decades.

Conclusion

The verdict is clear. Gold is reliably known to hold its value during troubled times. With frothy stock markets all around, maybe now is the time to increase the allocations for gold in one’s portfolio. Of course, it is true that in recent years there was a substantial correction in international gold price from the peak levels of 2011 and 2012. However, beginning from January 2016, gold prices have regained ground and have generally held steady in the range of US$ 1,200 to US$ 1,300.

Finally, all said and done, a prudent investor will be wise to invest her savings in a diversified basket of investment options such as bank deposits, mutual funds, real estate, equity shares, gold and gold jewellery, etc. It helps to spread the risk as against having all your eggs in one basket. Investment in gold and jewellery for the long term is a safe option because the supply of physical gold continues to be meagre in relation to the demand. Therefore, while the price may fluctuate, there is protection on the downside. Recently, Gold bonds have emerged as a useful alternative to those who buy gold purely for investment purpose who now get to earn some interest on their investments though it may not interest those who buy gold jewellery for consumption.