I write in continuation of my earlier article “Gold: Outlook for 2021 and the competition from crypto currencies” published in the February 2021 issue of this magazine. In that article, I had looked at how investors, uncomfortable with the surge in money printing by central banks, have fuelled a rush of money into digital cryptocurrency. The returns on gold during calendar year 2021 were far outstripped by the multi-fold rise in Bitcoin and other digital cryptocurrencies. Consequently, investors wary of the US dollar in this age of unprecedented fiscal and monetary stimulus, were shifting a part of their portfolio from gold to bitcoins. The size of the market for cryptocurrencies had reached a third of private sector gold investments in just a decade. I had concluded with the observation that had Bitcoin not emerged as an alternative, gold prices would have continued to move up to new peaks.

Now, looking at subsequent developments, in FY 2020, gold prices were steadily on the ascendant and closed with substantial gains of more than 24%. However, in FY 2021, gold did touch a record of USD 2,062 per ounce on 7 August 2020 but all the gains were given up by the end of the year to close flat at USD 1,685 per ounce. This was, of course, the year that bore the brunt of the pandemic. Due to prolonged lockdowns and other containment measures, the world economy had suffered much damage. The US GDP plunged by 32.9% (annualised) in the June 2020 quarter while the full year GDP declined 3.5%, its worst year since World War II ended. Likewise, India’s GDP contracted by a record 23.9% in the June 2020 quarter while its full year GDP for FY 2021 shrank by 7.3%.

Central banks respond to the pandemic

Responding to the economic distress, central banks around the world stepped up monetary stimulus. The US Fed Funds rate was dropped to near zero, and from June 2020 onwards, they began a new round of quantitative easing to pump money and shore up the economy. The US Fed is currently injecting liquidity to the tune of US $ 120 billion every month by purchasing $80 billion worth of US treasury bonds and $40 billion worth of mortgage-backed securities (to support the real estate market). This money is all newly created money, in other words, created out of thin air.

Further, to alleviate distress among ordinary people, the US government also added fiscal stimulus as part of Covid relief. By the time Joe Biden took over as President, most Americans barring the wealthy had already received two payments of $1200 and $600 per person. After the passage of President Joe Biden’s $1.9 trillion American Rescue Plan in March 2021, millions of Americans have received a further one-time direct payment of up to $1,400 each. On top of all this, the US Federal government has been providing an extra weekly payment of US$300 to all its unemployed citizens (which expires in September 2021).

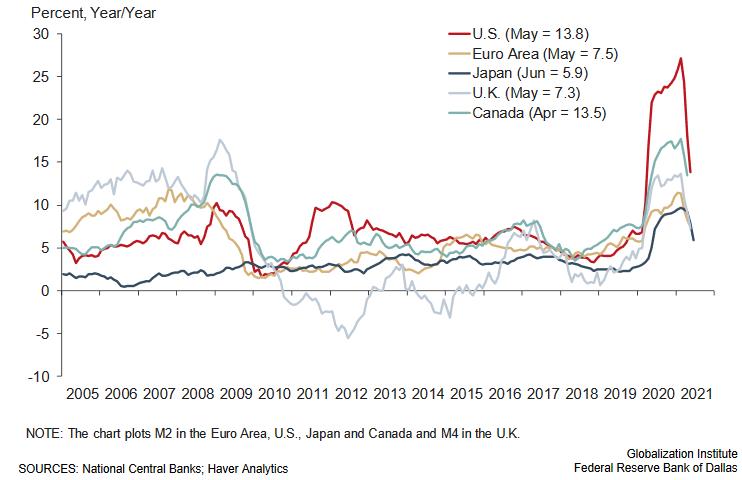

The US was not alone. When financial conditions began to tighten in March 2020, most central banks in the advanced economies rapidly injected liquidity through market operations and purchased government bonds to support market functioning. Other measures to support economic activity included lower policy rates, the introduction of new or expanded asset purchase programs, and schemes to lower longer-term interest rates and to support the flow of credit to businesses and households.

Chart 1: Money Supply Growth in Major Advanced Economies

With all this free money sloshing around, and with interest rates held at near zero levels, conventional wisdom would suggest that the price of gold should have shot through the roof. However, the reality is that after the peak of US$2,062 on 7 August 2020, gold prices ended up correcting sharply and touched a low of US$1,685 on 31 March 2021. Since then, it has gained somewhat but continues to struggle to hold levels above US$1,800.

What could be the reasons or the likely factors holding down gold and preventing its rise to the levels expected of it? Many analysts would point to the strength of the recovery in the global economy and the rapid gains in the stock market as factors shifting money away from gold. While this is true for now, the fact is, investors who put money into gold are often those seeking a safe haven investment, especially at a time of valid fears about currency debasement causing a resurgence of inflation. The US Fed has printed money at a frenetic pace after the pandemic, and the run-up in inflation has already begun. In April this year, US consumer price inflation registered an increase of 4.2% over the year, with equally hefty increases in the months following. Yet, gold price has not gained as conventional wisdom would suggest.

The Bitcoin Factor

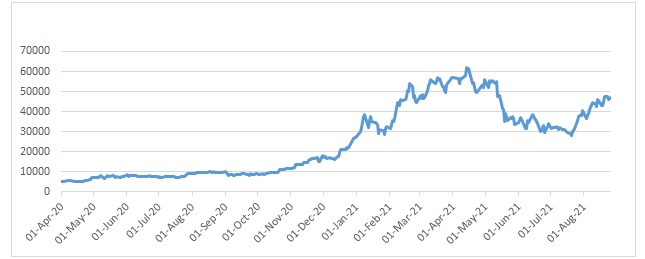

That brings us to Bitcoin and the outsized gains this cryptocurrency has posted over the last one to one-and-half years. Consider the period from 7 August 2020 onwards. That was the day that gold price had hit a peak of US$ 2,062 per ounce and Bitcoin was trading at US$11,592 per digital coin. Fast forward to recent days (first week of September) when gold trades at about US$ 1,812, a decline of 12% from the peak, while Bitcoin is fetching US$ 49,999 apiece, more than 4 times the level on 7 August 2020. The below table plots the difference in price between one Bitcoin and one troy ounce of gold, and it shows how much Bitcoin has gained over gold in recent months.

Chart 2: US Dollar vs. Bitcoin – Difference in US$ price between one Bitcoin and one ounce of Gold

Bitcoin is a decentralized digital currency without a central bank or single administrator which can also be transferred from user to user on the peer-to-peer bitcoin network which does not need intermediaries. Transactions are recorded in a public distributed ledger called a block chain after they are verified by network nodes using codes (cryptography) which also ensures anonymity for the users. The currency began use in 2009 when its implementation was released as open-source software.

The idea behind a decentralized cryptocurrency was to eliminate centralized control of money from government agencies. An alternate currency, outside the purview of governments and government agencies, is an idea with merit and appeals to our instinct or gut feeling.

By design, Bitcoin limits the maximum number of bitcoins that can be generated to 21 million. This is cited as an advantage over paper currency that can be printed at will by central banks. Besides, its design makes it especially useful for international transfers which would attract currency conversion charges otherwise, and also carry settlement and counterparty risks. Another point in favour of Bitcoin is that you don’t need a bank account to transact with Bitcoins.

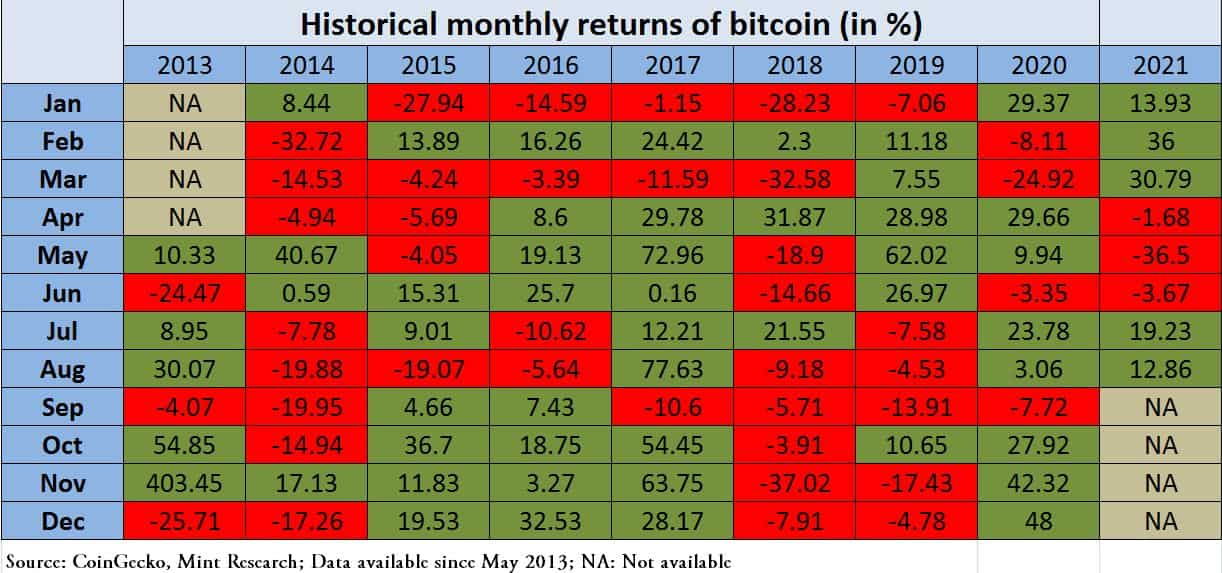

However, the drawbacks are also equally, if not more, substantial. Firstly, it is not backed by any physical asset and that makes it just like any fiat or paper currency. Secondly, a very important function of currency is to act as a store of value. The sheer volatility in Bitcoin prices makes it unreliable as a store of value though speculators would find it attractive. Thirdly, in its role as a currency for day-to-day transactions, it suffers from systemic limitations such as painfully slow transaction speeds. That’s because each transaction requires validation by a network of other users called “miners” who solve complex mathematical problems to verify the transactions on the network. The miners get rewarded by bitcoins based on their success in solving such problems.

The below able shows the month-to-month volatility in the price of Bitcoin since 2013 which points to its unsuitability as a store of value.

Bitcoin is a decentralized digital currency without a central bank or single administrator which can also be transferred from user to user on the peer-to-peer bitcoin network which does not need intermediaries. Transactions are recorded in a public distributed ledger called a block chain after they are verified by network nodes using codes (cryptography) which also ensures anonymity for the users. The currency began use in 2009 when its implementation was released as open-source software.

The idea behind a decentralized cryptocurrency was to eliminate centralized control of money from government agencies. An alternate currency, outside the purview of governments and government agencies, is an idea with merit and appeals to our instinct or gut feeling.

By design, Bitcoin limits the maximum number of bitcoins that can be generated to 21 million. This is cited as an advantage over paper currency that can be printed at will by central banks. Besides, its design makes it especially useful for international transfers which would attract currency conversion charges otherwise, and also carry settlement and counterparty risks. Another point in favour of Bitcoin is that you don’t need a bank account to transact with Bitcoins.

However, the drawbacks are also equally, if not more, substantial. Firstly, it is not backed by any physical asset and that makes it just like any fiat or paper currency. Secondly, a very important function of currency is to act as a store of value. The sheer volatility in Bitcoin prices makes it unreliable as a store of value though speculators would find it attractive. Thirdly, in its role as a currency for day-to-day transactions, it suffers from systemic limitations such as painfully slow transaction speeds. That’s because each transaction requires validation by a network of other users called “miners” who solve complex mathematical problems to verify the transactions on the network. The miners get rewarded by bitcoins based on their success in solving such problems.

The below able shows the month-to-month volatility in the price of Bitcoin since 2013 which points to its unsuitability as a store of value.