By VP Nandakumar

In recent months, gold prices have fallen significantly from the highs recorded last year following the widespread economic disruption after Covid-19. The international price of the metal had crossed US$ 2,000 per troy ounce in August 2020 but has now declined to about US$ 1,700 currently. Given this volatility, it is no surprise that gold loan financiers should be flooded with media queries about the likely impact of such a price correction on their profitability and growth prospects.

Having been involved in the gold loan business for decades, I speak from experience when I say that gold price volatility has next to no impact on the gold loan business, barring a short term effect which gets normalised as the new prices become the new normal. Moreover, the gold loan business has also evolved over time to make itself more resilient to these price fluctuations. The change is most apparent in risk management, where the old ways of doing things have given way to new thinking. Risk management in the financial sector is a critical function which determines whether you survive or not in a world where only the fittest survive. As the theory of evolution explains, the survival of the fittest is all about the ability to adapt and change according to the environment. The same rules apply to the corporate world, including in the lending business. For example, if Manappuram Finance Limited (the company that I founded in 1992) had continued to function exactly as it did in the '90s, it would have soon fallen by the wayside.

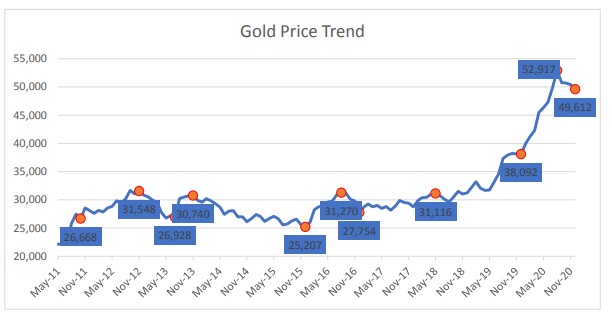

Gold Price trends in India

Gold prices in India have grown 15-fold in the last 30 years, from about Rs 3,000 in 1992 to Rs 45,000 level today. However, there have also been periods when gold prices went into a bearish phase.

In 2012, the RBI stepped in and completely overhauled the functioning of the organised gold loan market by introducing a slew of new regulations, including a cap on the maximum permissible loan to value ratio (LTV). Initially, this cap on LTV was fixed at 60% and within a year revised upwards to 75%. Gold prices fell by 25% over the next two years, before resuming its uptrend in 2015. Thereafter, prices peaked in 2017 and then fell by 15% within a few months. The next upcycle lasted till August 2020 after which gold prices in India have fallen by 19% from Rs 54,500 to Rs 45,000 level currently.

Risk mitigation with short-term gold loans

When we first started lending against gold jewellery, there were no restrictions on loan to value (LTV) ratio, and there were no regulations that limited the amount people could borrow against their jewellery. Gold loans were usually given out for a period of one year and there was no requirement about having to service interest periodically. Indeed, bullet repayment of both the principal and the accumulated interest was the norm. While defaults remained minimal and actual losses were kept well under control, there was an ever-present element of risk to this set-up. Should the price of gold fall significantly after the loan is given out, the realisable value of security would fall below the principal amount and the interest accumulated thereon, leading to the possibility of a loss for the lender should the borrower choose not to repay.

The demand for gold loans got a boost in the aftermath of the global financial crisis in 2008. This was partly because of continuously increasing gold prices, the consequence of the ballooning balance sheet of the US Federal Reserve Bank and the large fiscal and monetary stimulus unleashed across the globe. Besides, most of the other borrowing avenues for small business had dried up, leaving gold loans as one of the few remaining options.

In 2014, looking at the increasing volatility in gold prices, we at Manappuram decided to shift the bulk of our gold loans to 3 months tenure from the one-year product that was the industry standard. The purpose was to minimize the price risk that gold loans are subject to. The price risk is the risk of loss when the value of the jewellery pledged is no longer sufficient to cover the outstanding loan amount. However, even as we shifted to short-term gold loans, most of the other players continued with the one-year gold loan product. On our part, we were clear in our minds that we were in the business of lending against gold jewellery and not in its trading. We recognised that we do not have expertise in predicting where the gold prices are headed for. When we give out a gold loan for a certain duration (whether three months or one year), the borrower has no obligation to make any payment in the interim, and only needs to repay the principal along with accumulated interest at the time of closure. When he takes a three-month loan, he can renew or rollover his loan account after three months by paying the interest and resetting the loan to the current gold price.

Effectively, when we lend against gold for three months, we are taking on the metal price risk for the period, whereas on a gold loan of one year tenure, the lender bears the price risk for the extended period of one year. Further, the compounding interest accrued over the whole year is also to be added. In periods when gold prices keep increasing year after year (as it happened during the bull run in gold from 2003 to 2011), there is perhaps little risk in lending for one year. However, when the tide turns and prices begin to fall, you may end up holding the short end of the stick. Let me elaborate on this risk perspective with an example.

At Manappuram, our gold loan products went through three different phases. Before the 2012 regulations capping LTV came into force, we offered gold loans up to 90% of LTV for a tenure of up to a year. For the purpose of this example, let’s call this product Type-C. After the LTV cap was set at 75% by the regulator, we restricted the LTV to 75% but the tenure was still kept at one year (product Type-B). Later, in FY-2015, we introduced our three-month gold loan products at an LTV of 75% (product Type-A).

How do these varying product types deal with the gold price risk? In particular, how does the three-month gold loan deal with price risk by its very product design?

Let's say in August 2020, when the gold price was Rs.5,500/gm, the company gives out a loan of Rs. 4,125 for three months (renewable) at 75% LTV (product Type-A). At the same time, the company also gives out a loan of Rs. 4,125 for one year at 75% LTV (product Type-B) and another loan of Rs 4,950 for one year at 90% LTV (product Type-C). For the sake of simplicity, we will assume that all these loans carry the same rate of interest at 12% per annum.

After August 2020, gold prices started falling. Now let us further assume that the customer won’t have a surplus with him to make good any shortfall in collateral value (arising from a decline in gold price) when closing or renewing the loan. For a loan with a tenure of three months, the NPA classification would kick in after 90 days, i.e., by January/February 2021 (March quarter) while for the one-year tenured loans, the NPA classification would happen in October/November 2021 (December quarter).

As the gold price now has fallen to Rs.4,500/gm level, the outstanding loan amount including accrued interest for product "A" would be Rs.4,250, lower than, and adequately covered by, the realisable gold value. In the scrap resale market, auctions typically fetch less than the notional value on account of information asymmetry (the typical lemons problem). If gold prices remain at the same level, by October/November 2021 (December quarter), the outstanding amount for loan product "B" would be Rs. 4,635 which is higher than the total realisable value of the collateral. Similarly, for product "C", the outstanding loan amount would be at Rs.5,545, which is way above the realisable value of the collateral. Indeed, gold prices would need to go up by a massive 23% for these products to recover their dues.

However, under our present accounting standards, the one-year loans (B & C) would be reported as standard assets until the December quarter, with the company allowed to show accrued interest as income booked. In truth, the realisable value of the collateral is below even the principal amount. On the surface, the portfolio looks pristine and the company can report healthy growth for a few more quarters, even as the insiders would know that the assets on the book have turned bad (barring a miraculous recovery in gold price).

The short-term product "A” carries much lower gold price risk as its duration is only three months and interest accruals happen only for this short period. If the customer fails to settle or renew the account, the lender can initiate the process of recovery by the March quarter itself. However, in the case of the long-term products B & C, the lender would have to wait for another 9 months or so, until October or November 2021 (December quarter), before initiating the recovery process. Should gold prices fall even more over these 9 months, the yield on the asset would suffer even more.

Summing up, product "A" is required to take the first punch from the falling gold prices, but it emerges unscathed. Products B & C are likely to take a hard punch to the gut if gold prices don’t recover in the next few months. Apart from the delayed acknowledgement of the deterioration in asset quality, products B & C would continue to report a higher growth in portfolio AUM, whereas product A would have acknowledged all the stresses in the March quarter itself, allowing for prompt corrective action before setting itself up for profitable future growth without the burden of NPAs.

At Manappuram, during the previous episode of gold price volatility, we had realised that a short-term gold loan product is the best way to manage the gold price risk and accordingly worked hard to shift our entire gold loan portfolio to the three-month product "A". The short-term product offers benefits both to the customer and to the company. The company is able to manage the price risk and asset quality prudently, without taking away flexibility to the customer in terms of his credit requirements. The periodic renewal of the loan and the regular servicing of interest by the customer enforces credit discipline and it also lowers the interest burden on the customer.

Published in Unique Times Magazine, April 2021

(V.P. Nandakumar is MD & CEO of Manappuram Finance Ltd. Views are personal.)